Here’s What To Look For From The Upcoming VBI Vaccines, Inc. – Ordinary Shares (NASDAQ:VBIV) Phase III Study

VBI Vaccines, Inc. – Ordinary Shares (NASDAQ:VBIV) just announced the details of its long awaited phase III program in hepatitis B. The program, if successful, will underpin registration applications for VBI’s lead hepatitis B asset in the US, Europe and Canada and – as such – its initiation is a major step towards the company dramatically increasing its target population.

Markets are yet to respond to the news, meaning there exists an opportunity right now to get into the stock ahead of VBI revaluing to reflect the operational advance.

With this in mind, here’s a look at the details of the trial, what’s important about how the trial is set up and what to look for going forward as indicative of successful execution and – in turn – a long term bull thesis on the company.

So, as mentioned, it’s a hepatitis B program and it revolves around an asset called Sci-B-Vac. For those new to this company, VBI has developed a platform through which it is able to create next generation vaccines that are designed to build on the immunogenicity and seroprotection offered to patients as part of the current standard of care vaccines. In this instance, the target is hepatitis B and the current standard of care vaccine in this space is Engerix-B.

Engerix-B is effective across a decent portion of the global population but it has its limitations. First, it commands a drawn out dosing regimen, which can lead to non-adherence and – by proxy – a failure of the drug to induce immunization. Second, it’s not particularly effective in certain subgroups of the population; namely, immunosuppressed patients. People with diabetes often fail to achieve seroprotection, even after completing a stringent dosing regimen of Engerix-B. The same is true with elderly patients and patients with chronic kidney disease.

Sci-B-Vac is designed to incorporate three different hepatitis B related antigens, which can help to increase the immunogenicity of the vaccine by increasing the variety of antibodies that are created in response to the vaccine being presented to the immune system. It also doesn’t require the adjuvant that’s generally attached to the standard of care treatment (in the case of Engerix-B, it’s aluminum).

VBI has conducted numerous early and mid stage trials that have demonstrated the safety and efficacy of Sci-B-Vac across a range of population types – regular, immunosuppressed, etc. The drug is also already approved in a number of countries globally and is one of two standard of care hepatitis B vaccines for newborns (it shares this title with the above discussed Engerix-B) in Israel. This means that, in addition to the data collected formally by the company as part of clinical trials, there also exists a huge data set derived from everyday administrations – all of which prove that this is a safe and effective alternative to the standard of care therapy.

On its own, however, this data isn’t enough to justify approval in the above three noted major markets – the US, Europe and Canada. The regulatory authorities in these regions – the FDA, the EMA and Health Canada respectively – require an investigator sponsored phase III trial to form the basis of an application for approval and it is this trial for which the company just served up the details.

Before getting into the trial specifics, it’s worth noting that, over the last six months, VBI has put together three pieces of the approval puzzle for this particular asset. Specifically, these pieces are confirmation from the FDA, the EMA and Health Canada that a single, global phase III program would be enough to underpin an application in each region. In other words, confirmation that the company won’t have to conduct three separate programs, one for each region. This confirmation from Europe and Canada came back in February. Markets had to wait a little longer for US confirmation but it eventually came in June.

This latest release, then, confirming trial design, is a fourth piece of the puzzle and the final one necessary before initiation.

So, let’s look at the trial.

As mentioned, it’s a single global program that’s set up to underpin registration applications in the US, Europe, and Canada and, according to the study design, it’s going to consist of two phase III studies. The first will be a safety and immunogenicity study called PROTECT and the second will be what’s called a lot-to-lot consistency study called CONSTANT. All told, both studies will enroll approximately 4,800 subjects and will be conducted at approximately 40 sites across the U.S., Europe, and Canada.

It’s worth noting here that a count of 4,800 patients is relatively low for a pivotal trial in a common indication like hepatitis B. The reason that the company is able to keep this number so low is that, as described above, there already exists a large set of data supportive of safety and efficacy. According to the company’s latest release, this set includes data from more than 2,000 patients.

Anyway, let’s look at the two phase III trials.

The PROTECT study will be a double-blind, two-arm, randomized, controlled study, enrolling approximately 1,600 adult subjects all of which are age 18 years and older. Subsequent opt enrollment, the patients will be randomized in a 1:1 ratio to receive either a three-dose course of Sci-B-Vac (at a 10μg dose) or a three-dose course of the control vaccine, which is the above discussed Engerix-B (at a 20μg dose).

There are two primary endpoints associated with the study.

The first is the demonstration of non-inferiority of the seroprotection rate induced by the active drug versus the control drug, four weeks after the third vaccination. This one relates specifically to patients aged 18 and older.

The second is the same, but superiority (as opposed to non-inferiority) in patients aged 45 and older. This one is an attempt to prove that the drug can be more effective in the immunocompromised population, as discussed above.

The CONSTANT study is a double-blind, four-arm, randomized, controlled study that will enroll approximately 3,200 adult subjects, age 18-45 years. In this one, the patients will be randomized in a 1:1:1:1 ratio to receive one of four three-dose courses – Lot A of Sci-B-Vac 10μg, Lot B of Sci-B-Vac 10μg, Lot C of Sci-B-Vac 10μg, or the control vaccine Engerix-B 20μg.

For those not familiar with these lot-type studies, the point is to show that the effect that the drug has on the patients is the same across a variety of different lots (just think of these as batches) of the drug in question. In this instance, VBI is trying to show to the regulatory agencies that Sci-B-Vac is consistently manufactured and – by proxy – has a consistent impact (in terms of seroprotection induced) across a range of different batches. The consistency in this instance is measured using what’s called geometric mean concentration (GMC) of antibodies.

The best way to think of this second study is as it being a study geared towards demonstrating a consistency of quality of the product, as opposed to specifically addressing efficacy. Of course, safety and efficacy will be measured (in fact, they comprise the secondary endpoint of this particular part of the program), as these metrics will also be used to measure quality across batches.

So, what are we looking for from the trials as indicative of success?

From the first study, we want to see two things.

First, that the drug is as effective in inducing seroprotection in adults aged 18 plus as is Engerix-B. That’s sort of the core primary endpoint. The second primary endpoint, however, the one looking at patients aged 45 plus in this author’s opinion, is more interesting. Not necessarily more important, as the primary needs to be hit, but more interesting.

Why?

Because there’s a very large market available to VBI if it can show that its asset is superior to Engerix-B in immunosuppressed patients. This second primary endpoint is geared towards proving just that.

From the second phase III, we just want to see safety and consistency between lots. It would be nice to see superiority in efficacy as compared to the individual lots and Engerix-B but it’s not essential.

As far as timelines are concerned, VBI hasn’t served up any specific dates for enrollment initiation but the company expects to kick off both studies during the second half of this year. With a 15-month time to completion, this means we should see topline hit press during the first half of 2018.

Disclosure: The author has no shares in any of the stocks mentioned in this article.

A World Renowned ‘Big Mining’ Geologist Is Working To Build The Next Billion Dollar Junior Gold Company: Dataram Corp (NASDAQ:DRAM)’s US Gold Corp.

Back in 2011, as part of this interview conducted by Rockstone Research, mining analyst Stephan Bogner asked the interviewee, geologist David Mathewson, what drove him to become a part of the then young gold exploration company Gold Standard Ventures Corp (NYSEMKT:GSV). Bogner highlighted Mathewson’s career to that point – something we’ll look at in more detail shortly – as justification for the suggestion that a tiny explorer, worth just a few million dollars and with nothing in the way of confirmed resources at that point, wasn’t really worthy of the geologist’s time and attention.

When you’re one of the most respected geologists in the world, in other words, why devote your attention to a tiny player in the space?

Mathewson answered as follows:

“Successful exploration is all about applying effective and often new ideas, basically geological concepts, in entrepreneurial ways… public junior exploration companies provide the best vehicles to do exactly what needs to be done to be successful.”

This year, Gold Standard Ventures hit a market capitalization of more than $600 million. The development of the projects that account for the vast majority of this valuation, the Railroad-Pinion district and the North Bullion and Bald Mountain discoveries, was spearheaded by Mathewson during his time at the company.

Prior to his time at Gold Standard Ventures, Mathewson accrued more than thirty years’ worth of experience as a geologist in the gold sector, with the vast majority of this time spent in senior exploration positions at gold mining giant Newmont Mining Corp (NYSE:NEM). He served as Head of Exploration in Nevada for the company, and is credited with some of the major discoveries across the Carlin Trend and the Great Basin – two of the most resource rich gold areas in the world.

So, why are we talking about him here?

Well, a company called Dataram Corp (NASDAQ:DRAM) is on the verge of acquiring a company called US Gold Corp. Dataram is a NASDAQ traded technology company that is looking to diversify its operations, and it’s doing so through said acquisition, which management expects that (subject to shareholder approval) will close in between 60-90 days.

US Gold Corp. is a young, currently privately held (but soon to be available on the public markets by way of the just noted acquisition) natural resource miner, with two high-potential projects in Nevada and Wyoming.

The company’s CEO is Edward Karr, a respected investment banker. Its COO is David Rector, a gold industry veteran.

And here’s the most interesting part – VP, Head of Exploration is Mathewson.

What we’re looking at here, then, is a company that is in an almost identical position today, to that of the above-discussed Gold Standard Ventures back when Matheson joined at the turn of the decade. That is, it’s a young company with a couple of promising projects, looking to develop its assets into resources that it can sell to, or use as the basis of JV agreements with, incumbent mining entities.

If successful, and a look at Mathewson’s track record suggests there’s a good chance that under his direction it will be, we’re looking at a huge potential upside from current valuation (for reference, Dataram’s market capitalization as of April 24 is $5.8 million).

With this in mind, then, let’s look at the projects in question.

Two properties comprise the company’s asset portfolio right now. These are the Keystone project, located in Nevada, and the Copper King project, located in southeast Wyoming. The former, Keystone, is the project in which Mathewson has had a hand, and it’s likely going to be the primary value driver for the company going forward – that is, it’s the project on which US Gold Corp. is basing much of its long-term valuation.

As thing stand, however, it’s at an earlier stage of development than Copper King. To put this another way, Keystone is an exploration asset, while Copper King is a near-term production asset.

Copper King is located 20 miles west of Cheyenne, Wyoming’s capital, and most populous city. It’s what’s classed as an advanced exploration and development property, and it falls within the Silver Crown Mining District of the state, a district well known for its mining friendly economics.

Back in 2012, a group called Mine Development Associates (MDA) published a Preliminary Economic Assessment (PEA) detailing the resource and its estimates. As per the PEA, Copper King boasts the following:

- 1,534,000 Measured and Indicated gold equivalent ounces

- 345,000 Inferred gold equivalent ounces

- $159.5 million Net Present Value (NPV) at $1,100/oz. Au and $3.00/lb. Cu

Of course, gold is priced higher than the per oz. price used for this assessment (most recent spot price $1,256 versus the $1,100 used above), meaning the NPV is likely considerably higher than the PEA implies. Copper is down slightly ($2.55 versus the $3.00 used), but the negative impact on NPV that the decline in copper implies should be outweighed by the positive impact on NPV brought about by the rise in gold.

Over the coming twenty-four months, US Gold Corp. intends to execute on a development strategy that should bring with it numerous catalysts, each of which has the potential to induce an upside revaluation for the company as and when they hit press. During 2017, these catalysts include an updating of the PEA (to adjust the above-discussed cost inputs) and the initiation of a permitting strategy. During 2018, management expects to move to advance into a Pre-Feasibility Study (PFS), as well as continue to explore and develop the property to refine estimates (and potentially expand estimates) ahead of permitting.

Beyond this activity, we see a JV announcement, or the offloading of the property to a larger name (which is becoming an increasingly popular exit strategy in the junior gold space, based on the reduction in exploratory activity during the low-gold years) – each of which could initiate a dramatic upside revaluation.

That’s the Copper King project; what about Keystone?

As mentioned, this is the big one for the company. It’s the project Mathewson has identified as potentially being even more valuable than the Railroad resource that underpinned the Gold Standard Ventures $600 million valuation, and it’s the resource we’re looking to as providing numerous development-type catalysts in parallel to the Copper King advances.

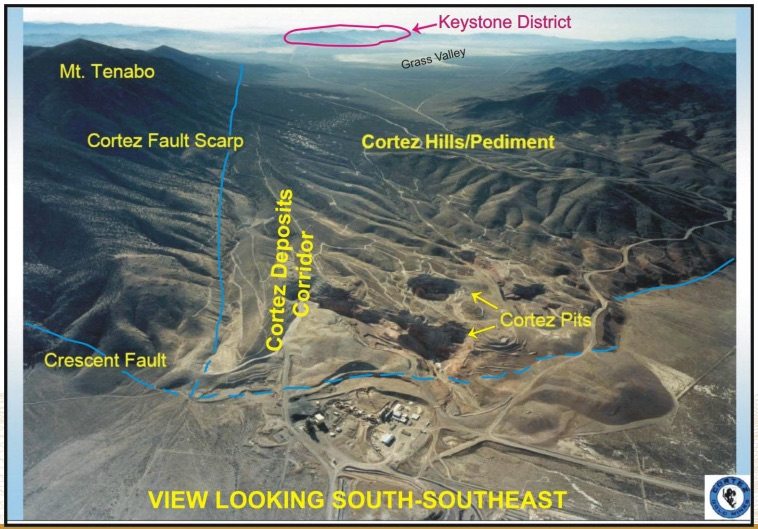

One of the most notable qualities of the project is that it’s located on the Cortez Gold Trend, just 10 miles south of Barrick Gold Corp (USA) (NYSE:ABX)’s Cortez mine – one of the largest mines in the world and one of Barrick’s flagship complexes, with nearly 10 million oz. in proven and probable reserves. The project produces around 1 million oz. annually. The image below illustrates the location of US Gold Corp.’s Keystone project in relation to the Cortez complex.

Mathewson recently discovered and consolidated the project, and US Gold Corp. is banking on the idea that this is his next big discovery, and that it will add to his long list of successful discoveries (and developments) in Nevada across his thirty-five-year career in the state.

The project itself covers more than 15 square miles of mining claims, and based on drilling to date, has been shown to contain high grade, thick intercepts of gold at very shallow depths. This means two things: that the extraction of the shallow resource should be relatively cheap, and that there’s likely more gold below the shallow intercepts.

So what’s next at the project – or in other words, where are the catalysts coming form with relation to Keystone?

The majority of 2017 will be spent surveying the property in an attempt to identify the potentially most rewarding regions, and claims, and to put together some solid estimates as to what the project might hold from a resource perspective. Once surveyed, Mathewson is going to identify initial drill targets (this is his specialty) and with these targets in place, the drilling program will kick off.

Throughout 2018, then, the company is going to execute on the drilling program and prove up its discoveries (and in turn, its estimates) on the back of the drill results.

Just as with Copper King, we expect (and this is supported by management communication) that the exit strategy on this one will be to develop to a point just pre-production, and then offload the project to a larger name, or strike a JV agreement. This helps the company to avoid the costs of a ramping up to production, while maintaining an interest in the gold that its team has worked to prove.

Bottom line: there are plenty of potential catalysts across the coming two years, a respected and experienced management team and one of the industry’s most well known, and highly regarded, geologists/explorers at the helm of the project’s advancement. US Gold Corp. is also debt free, and based on an October 2016 financing that saw the company net just shy of $12 million, is fully funded through end 2017.

This is early stage gold, so it’s not a risk-free exposure. That said, for an investor looking to allocate to the space who is also looking for a quality that puts said allocation ahead of its peers, US Gold Corp., and Mathewson, is the stock to watch.

Here Are The Next Major Catalysts To Watch From VBI Vaccines, Inc. – Ordinary Shares (NASDAQ:VBIV)

VBI Vaccines, Inc. – Ordinary Shares (NASDAQ:VBIV) has had a strong start to 2017, currently trading for a circa 22% premium on it’s December close price. For this young biotechnology company, however, things are really only just getting started. With a diverse pipeline of development stage assets, and a commercial product poised for expansion in to two of the largest global markets, VBI has a spate of near term catalysts that promise to inject some upside momentum into its market capitalization if they come out as favorable.

In anticipation of these catalysts hitting press, here’s a look at each one individually, and an analysis of why (and to what degree) we expect it to move the company’s share price.

For those new to VBI, let’s kick things off with a quick introduction to the company. We’ve already noted it’s a biotechnology entity, and its primary focus is in developing assets related to the vaccine space. Right now, its lead programs are a hepatitis B vaccine called Sci-B-Vac; a cytomegalovirus (CMV) vaccine called VBI-1501A; a glioblastoma multiforme (GBM) immuno-oncology candidate called VBI-1901; and a vaccine stability platform that promises has the potential to dramatically reduce the cost of vaccine transportation and storage. Secondary programs include vaccines in respiratory syncytial virus (RSV) and Zika, as well as an immuno-oncology asset targeting medulloblastoma.

We are going to go into a number of these assets in a little more detail shortly when we look at the catalysts.

Before doing so, however, a short note on institutional interest.

For a company of its size (a $150 million market capitalization as of end January 2017), VBI has attracted an unusually high caliber of institutional interest and big name backers. Through Opko Health Inc. (NASDAQ:OPK), billionaire biotechnology entrepreneur, and the focus of a feature in January’s print edition of Forbes Magazine, Dr. Philip Frost, owns 25% of the company. Joseph Edelmen, a recent addition to Institutional Investor’s Hedge Fund Rich List having earned $300 million during 2015, through his biotechnology fund Perceptive Advisors, owns 15.8% of VBI.

With that noted, let’s move on to the catalysts.

The first event of note is rooted in the CMV vaccine. VBI kicked off a phase I study investigating safety and efficacy of the vaccine in 128 patients in September 2016. The study spread sites across three locations in Canada, and aimed to determine the immunogenicity of the drug in question, the above mentioned VBI-1501A.

CMV is generally a silent virus, meaning that the majority of those infected don’t display any symptoms. In certain sub-populations of those infected, however, it can be very serious. The virus can cause serious disease in newborns when a mother is infected during pregnancy; what is known as congenital CMV infection. Each year, approximately 5,000 U.S. infants will develop permanent problems due to CMV, some of them severe, including deafness, blindness, and mental retardation. Economic costs associated with the infection total $2 billion annually in the US, and the virus affects more live births than both Down’s Syndrome and Fetal Alcohol Syndrome.

Right now, there’s no commercially available vaccine, and VBI is working to fill this large unmet need in the US. Interim data from the immunogenicity phase I study that the company initiated in December was initially reported to be scheduled for release during the first half of 2017. However, VBI now expects to report this data during the first quarter of the year. This represents the next catalyst for the company. Data from an animal study demonstrated efficacy of 95% 28 days post-second vaccination (the interim data will also report on post-second vaccination efficacy) so there’s a decent chance this catalyst should come out in favor of the company. If it does, it opens up the potential for a big name partnership on the vaccine.

The second catalyst we’re watching for relates to the hepatitis B vaccine, Sci-B-Vac.

This vaccine is currently available as a next generation hepatitis B vaccine in fifteen countries and currently has 50% market share in Israel, where approximately 500,000 patients have been dosed since the vaccine picked up regulatory approval in the region. It’s a third generation vaccine designed to build on both the safety and the immunogenicity of the currently available assets, and VBI has a strong bank of data that points to an improvement over current standard of care in both instances.

VBI generates revenues from the hepatitis B product right now, but the real potential is rooted in the US and European markets. Driven primarily by increasing immigration from medium and high-prevalence countries, growth in the hepatitis B therapeutics space will center in the US, Canada, the UK, France and Germany over the next half decade. Research puts the annual size of the market at $3.5 billion by 2021.

The company is looking to these regions, and especially the above mentioned US and European markets, to boost its top line going forward, and we should see VBI move a step closer to commercialization in these regions near term. Specifically, the company expects to kick off a phase III in Europe during the second quarter of this year, and this should be sufficient to underpin an application in both the US and Europe. Peak sales forecasts in these two regions come in at $200 million annually, so an approval in one or both will inject a considerable amount of upside momentum into VBI as and when they are announced.

These are just the primary, near term catalysts; those that we see as dictating sentiment (and in turn, valuation) between now and the second half of 2017. As the company’s remaining pipeline matures, we expect secondary catalysts to come in to play, and boost VBI outside of the CMV and hepatitis indications.

Looking finally at financials, VBI reported revenues of $300,000 during the third quarter of 2016 (the latest reported numbers) and just closed on a $23.6 million financing with the above discussed Perceptive Advisors. As such, while the company will likely need to raise cash at some point between now and its pipeline reaching full maturation, we don’t see it as a near term risk.

Here’s Who Just Picked Up Centrus Energy Corp (NYSEMKT:LEU) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Centrus Energy Corp (NYSEMKT:LEU) reported that Global X Management Co Llc. has picked up 334,459 of common stock as of 2017-01-30.

The acquisition brings the aggregate amount owned by Global X Management Co Llc. to a total of 334,459 representing a 4.42% stake in the company.

For those not familiar with the company, Centrus Energy is a trusted supplier of enriched uranium fuel for commercial nuclear power plants in the United States and around the world. With world-class technical and engineering capabilities, Centrus is advancing the next generation of centrifuge technologies so that America can restore its domestic uranium enrichment capability in the future.

A glance at Centrus Energy Corp (NYSEMKT:LEU)’s key stats reveals a current market capitalization of 46.29 million based on 7.56 million shares outstanding and a price at last close of $6.12 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-22, Bawabeh picked up 375,000 at a purchase price of $3.15. This brings their total holding to 1,850,000 as of the date of the filing.

On the sell side, the most recent transaction saw Bawabeh unload 1,215 shares at a sale price of $1.68. This brings their total holding to 1,130,785.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Centrus Energy Corp (NYSEMKT:LEU) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Manning & Napier Advisors Llc Picked Up Lululemon Athletica Inc. (NASDAQ:LULU) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Lululemon Athletica Inc. (NASDAQ:LULU) reported that Manning & Napier Advisors Llc. has picked up 6,232,797 of common stock as of 2017-01-23.

The acquisition brings the aggregate amount owned by Manning & Napier Advisors Llc. to a total of 6,232,797 representing a 4.56% stake in the company.

For those not familiar with the company, Lululemon Athletica Inc. is a designer, distributor and retailer of technical athletic apparel. The Company’s segments include Company-operated stores, Direct to consumer and Other. The Company offers a line of apparel and accessories for women, men and female youth. Its apparel assortment includes items, such as pants, shorts, tops and jackets designed for healthy lifestyle activities and athletic pursuits, such as yoga, running, other sweaty pursuits and athletic wear for female youth. The Company conducts its business through two channels: Company-operated stores and direct to consumer. It operates approximately 360 Company-operated stores located in the United States, Canada, Australia, New Zealand, the United Kingdom, Singapore, Hong Kong, Germany and Puerto Rico. Its direct to consumer segment includes lululemon and ivivva e-commerce Websites, www.lululemon.com and www.ivivva.com, and other country and region specific Websites.

A glance at Lululemon Athletica Inc. (NASDAQ:LULU)’s key stats reveals a current market capitalization of 9.20 billion based on 127.30 million shares outstanding and a price at last close of $66.70 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2015-09-21, Poseley picked up 4,000 at a purchase price of $53.52. This brings their total holding to 24,535 as of the date of the filing.

On the sell side, the most recent transaction saw Pitcher unload 5,310 shares at a sale price of $67.31. This brings their total holding to 20,160.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Lululemon Athletica Inc. (NASDAQ:LULU) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.