IPO Alert: Crypto Darkhorse Wellfield (TSXV-WFLD) Goes Public

Company Snapshot

Company Name: WellfieldTicker: WFLD.VExchange: TSXVWebsite: https://wellfield.io/ (Crypto Experts, highly recommend, too granular for a typical investor)Investor Deck: Here (Crypto Experts, highly recommend, too granular for a typical investor)Industry: Blockchain – Decentralized FinanceCompany Summary:Wellfield Technologies develops hardcore technology and easy to use applications that give blockchain the power to unlock the future of finance. WFLD creates decentralized, open, transparent, inclusive, and cost-effective financial products and services. Wellfield brings decentralized finance (DeFi) to traditional finance.

Top FOUR Reasons Why WFLD could become a Juggernaut with Massive Upside!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#2 IPOs can be massive for tech US IPOS have already totaled $171 billion#3 Wellfield understands the essence of crypto, deregulation#4 Wellfield’s team is impressive

[thrive_leads id=’9849′]

Before jumping into the main talking points, let’s look at the chart & a bird’s eye review on Wellfield.

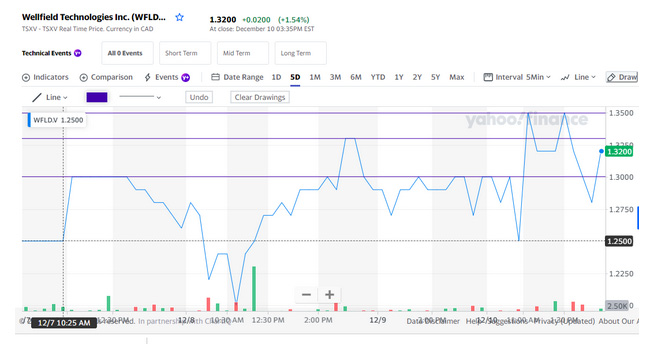

CHART LOOKS GOOD!

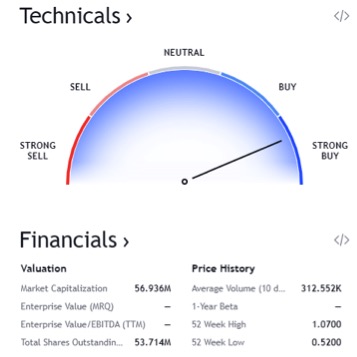

Technical Summary:

Wellfield had an intraday swing from $1.20 to $1.33 representing a 10% gain! Furthermore, WFLD finished the day BULLISH! As you see the three lines, the first line is on 12/7 price action at $1.30 and then the second line is a NEW HIGH! The third line is, you guessed it, a new high! This chart is shaping up marvelously.

Bird’s Eye View of Wellfield:Before we take a look at Wellfield, let’s review the backbone, dare I say, the huge bet on a new disruptive global finance mechanism, blockchain. Most people, unless you’ve been living under a rock, have heard of blockchain or cryptocurrency, which trades on the blockchain.

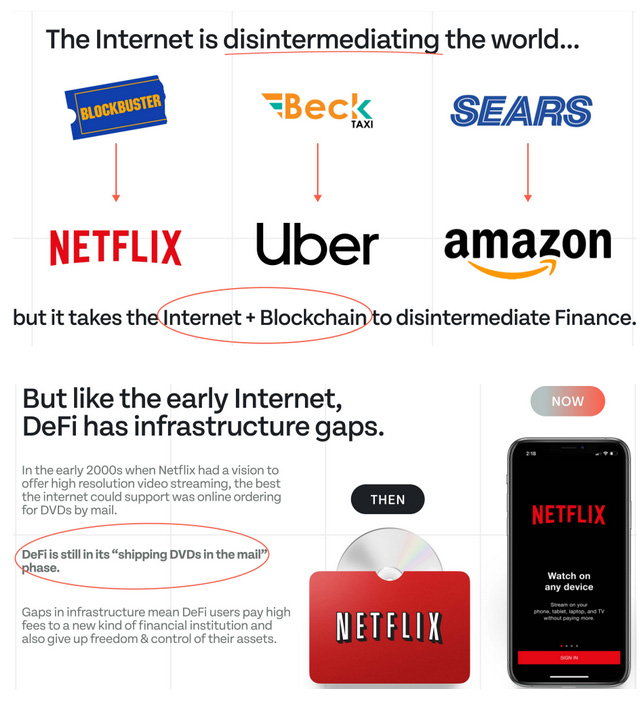

Blockchain has the potential to disrupt global finance and change the way we do banking forever, but just like the internet in its early days, blockchain’s capacity and performance are currently limited and the applications built on it aren’t relevant to most people.

Wellfield has developed critical technology that increases blockchains potential and makes it relevant to our everyday financial lives, let’s take a look!

What the heck do they do?

This is difficult because it is the new frontier. Imagine, it is the 6th of August 1991 and someone is describing the internet, Google and smartphones; you would be lost! We will try to do our best to explain the true MASSIVE value of Wellfield. I’m going to follow the old adage, Keep It SImple Stupid, K.I.S.S.!

Wellfield does 2 things:

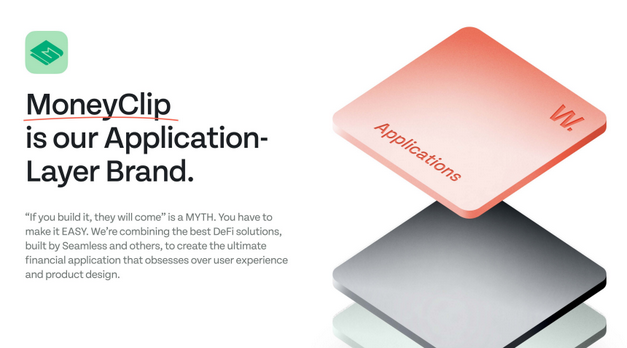

#1 Blockchain Applications (apps) – MoneyClip#2 Blockchain Protocols – Seamless

#1 Applications (apps) – MoneyClip

MoneyClip is truly the ultimate trading wallet, it links your bank to blockchain and gives you regulated access to the world’s best DeFi solutions.Above is the Wellfield jargon explanation to the power of their app. Although it is eloquent and chalked full of jargon, the real question is, what does all that mean?

We will do our best to explain their life-changing technology, but it is cutting edge technology that is over our head.

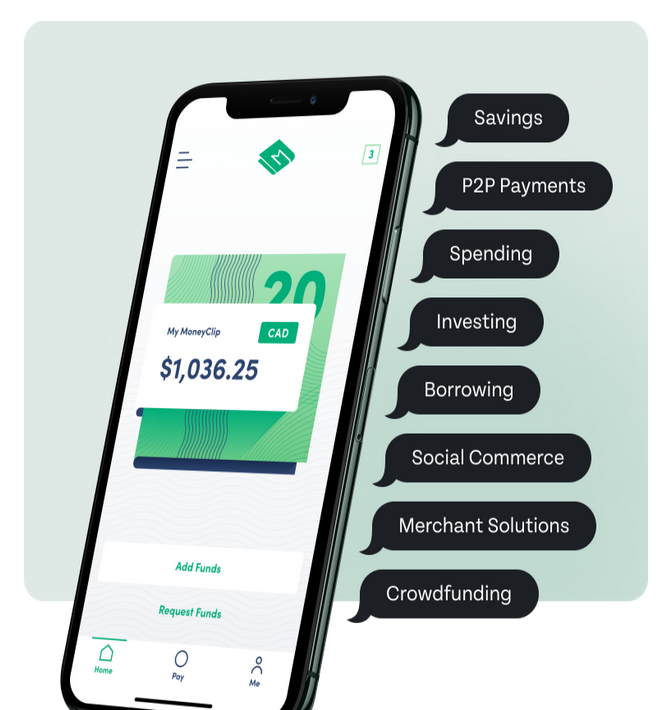

Here goes, nobody likes jumping from app to app, so we’re very excited about the all-in-one solution for savings, borrowing, merchant solutions, investing and so much more. It’s truly innovative even without the whole deregulation of crypto currency. So they go and develop this innovative application to operate on the blockchain so individuals and the government can’t be poking around in your business. It’s truly permissionless.

It’s kind of like, one app to rule them all. Sorry, for the Lord of the Rings reference, we couldn’t resist!

Their website is incredible, check it out here, maybe download it.

Top 3 reasons we love this App!#1 ControlThey promote “No hidden fees” or “recurring payments”, I don’t know about you but we’re big fans of that. #2 SimplicityYou can load digital cash on the go, make payments or send money from your phone, and easily request payments from individuals or groups. Earn high amounts on your balances without locking it into a GIC or buying an investment.#3 Privacy (our favorite)Well it’s not a conspiracy theory anymore, the governments around the world are tracking us. Moneyclip allows you to spend in person and online without leaving trails of personal data.

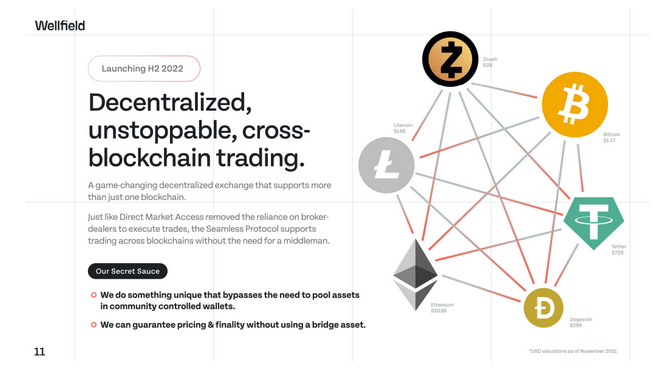

#2 Protocols (smart contracts) – Seamless

Wellfield touts that Seamless is “An ecosystem of protocols that removes the need for intermediaries.”

Well… Again, lots of sophisticated words by undoubtedly someone more intelligent than us, so we’re going to attempt to break down this cutting edge technology.

DeFi (Decentralized Finance) is not yet truly decentralized. Essentially, the whole mantra of crypto is built around decentralization. Meaning, we don’t want governments or five families to run the world banking system. So, crypto was born. Pretty cool in our opinion and many others agree with us, it’s the talk of the town!

Wellfield states, “With Seamless protocols, we accelerate the evolution of the internet”t” of money.

We read this to mean, the internet was built as a decentralizing and empowering technology creating a world where information and power is decentralized and delivered to the common person. That has not been actualized, but Seamless will speed up that reality.

- Top THREE selling points of Seamless are:1. Blockchain-agnostic2. Open3. Permissionless

#1 TAKEAWAYBy working with any blockchain, Seamless securely provides liquidity to the entire DeFi ecosystem.

Let us not forget about:

Security will be a cornerstone of Seamless.

The control and performance at scale will be unparalleled.

Seamless will be a truly decentralized protocol designed for DeFi services. Furthermore, it will be deployed on Ethereum for the global crypto community, as well as for MoneyClip users.

Now, Let’s Review The Top FOUR Reasons Why WFLD could become a Juggernaut!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#2 IPOs can be massive for tech US IPOS have already totaled $171 billion#3 Wellfield understands the essence of crypto, deregulation#4 Wellfield’s team is impressive

#1 Crypto & The Metaverse is the future, valued today at $3 TRILLION

The cryptocurrency market is now worth more than $3 trillion, that is a lot of 00000s.

“The little more than a decade old market for digital assets has already roughly quadrupled from its 2020 year-end value, as investors have gotten more comfortable with established tokens such as Bitcoin and networks like Ethereum and Solana continue to upgrade and attract new functionality. Excitement about the possibilities of decentralized finance and non-fungible tokens is growing, and memecoins like Dogecoin and Shiba Inu continue to attract attention.” Here

In case you have been under a rock, LOOK AT BITCOIN!

Crypto currency is positioning itself as the new currency of the future! Wellfield is building with Seamless the ability to monetize the possible Crypto takeover and be in a position to dominate the market!

#2 IPOs can be massive for tech US IPOS have already totaled $171 billion

Wellfield has a suite of technology and the resources to be a serious player in the blockchain ecosystem. But right now they’re pre-revenue and relatively unknown, trading on the TSX-V. As the market becomes aware of the company, and if they pursue a cross border listing, Wellfield can be a highly unique opportunity for the public markets. When will the us IPO launch?

“With more than six months until the year ends, U.S. initial public offerings have already totaled $171 billion, eclipsing the 2020 record of $168 billion, according to data from Dealogic.” Here

Wellfield just had an IPO on the TSX, the Canadian exchange, and now the question becomes when is the USA next?

#3 Wellfield understands the essence of crypto, DEREGULATION!

“”What Facebook is doing with meta…is a ‘fake metaverse,’ unless they actually have a real description as to how we can truly own it,” said Yat Siu, chairman and co-founder of Animoca Brands, an investor in and builder of metaverse platforms, speaking on a panel at the Reuters Next conference.” Here

The essence of crypto is disintermediation, freedom and taking back control and power from the banks and tech companies, hence the “fake metaverse” that Mr. Siu chastises Facebook for creating a BIG problem. Wellfield is a purist in the realm of the ideology of Defi, they are the opposite of META.

This will bodes well for them as they scale up, simply put, the backbone of crypto is built upon deregulation and they embody it.

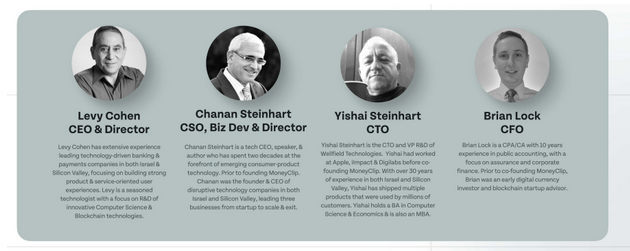

#4 Wellfield’s team is impressive

Wellfield’s Team is incredibly impressive with titans of silicon valley and finance.

“None of us is as smart as all of us.”

–Ken Blanchard

With that being said, take a look at the “us” in none of us is as smart as all of us!

Now, Let’s Review The Top FOUR Reasons Why WFLD could become a Juggernaut!

#1 Crypto & The Metaverse is the future est value today $3 TRILLION#2 IPOs can be massive for tech US IPOS have already totaled $171 billion#3 Wellfield understands the essence of crypto, deregulation#4 Wellfield’s team is impressive

Disclaimer :This is a paid advertisement and all individuals should verify all claims and perform their own due diligence on WFLD (and / or any other mentioned companies and / or securities), and read this disclaimer in its entirety.Small Cap Exclusive profiles are not a solicitation or recommendation to buy, sell or hold securities. Small Cap Exclusive is a paid advertiser and is not offering securities for sale. Neither Small Cap Exclusive nor its owners, operators, affiliates or anyone disseminating information on its behalf is registered as an Investment Advisor under any federal or state law and none of the information provided by Small Cap Exclusive its owners, operators, affiliates or anyone disseminating information on its behalf should be construed as investment advice or investment recommendations.Small Cap Exclusive does not recommend that the securities profiled should be purchased, sold or held and is not liable for any investment decisions by its readers or subscribers.Information presented by Small Cap Exclusive may contain “forward-looking statements ” within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Any statements that express or involve discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, goals, assumptions, or future events or performance, are not statements of historical fact and may be “forward-looking statements.” Forward-looking statements are based on expectations, estimates and projections at the time the statements are made that involve a number of risks and uncertainties which could cause actual results or events to differ materially from those presently anticipated. Forward-looking statements may be identified through the use of words such as “expects, ” “will, ” “anticipates,” “estimates,” “believes,” “may,” or by statements indicating that certain actions “may,” “could,” or “might” occur.THIS SITE IS PROVIDED BY SMALL CAP EXCLUSIVE ON AN “AS IS” AND “AS AVAILABLE” BASIS. SMALL CAP EXCLUSIVE MAKES NO REPRESENTATIONS OR WARRANTIES OF ANY KIND, EXPRESS OR IMPLIED, AS TO THE OPERATION OF THIS SITE OR THE INFORMATION, CONTENT, MATERIALS, OR PRODUCTS INCLUDED ON THIS SITE. YOU EXPRESSLY AGREE THAT YOUR USE OF THIS SITE IS AT YOUR SOLE RISK.TO THE FULL EXTENT PERMISSIBLE BY APPLICABLE LAW, SMALL CAP EXCLUSIVE DISCLAIMS ALL WARRANTIES, EXPRESS OR IMPLIED, INCLUDING, BUT NOT LIMITED TO, IMPLIED WARRANTIES OF MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE. SMALL CAP EXCLUSIVE DOES NOT WARRANT THAT THIS SITE, IT’S SERVERS, OR E-MAIL SENT FROM SMALL CAP EXCLUSIVE ARE FREE OF VIRUSES OR OTHER HARMFUL COMPONENTS. SMALL CAP EXCLUSIVE, ITS MEMBERS, MANAGERS, OWNERS, AGENTS, AND EMPLOYEES WILL NOT BE LIABLE FOR ANY DAMAGES OF ANY KIND ARISING FROM THE USE OF THIS SITE, INCLUDING, BUT NOT LIMITED TO DIRECT, INDIRECT, INCIDENTAL, PUNITIVE, AND CONSEQUENTIAL DAMAGES.CERTAIN STATE LAWS DO NOT ALLOW LIMITATIONS ON IMPLIED WARRANTIES OR THE EXCLUSION OR LIMITATION OF CERTAIN DAMAGES. IF THESE LAWS APPLY TO YOU, SOME OR ALL OF THE ABOVE DISCLAIMERS, EXCLUSIONS, OR LIMITATIONS MAY NOT APPLY TO YOU, AND YOU MIGHT HAVE ADDITIONAL RIGHTS. By using Small Cap Exclusive, you agree, without limitation or qualification, to be bound by, and to comply with, these Terms of Use and any other posted guidelines or rules applicable.The website contains links to other related World Wide Web Internet sites and resources. Small Cap Exclusive is not responsible for the availability of these outside resources, or their contents, nor does Small Cap Exclusive endorse nor is Small Cap Exclusive responsible for any of the contents, advertising, products or other materials on such sites. Under no circumstances shall Small Cap Exclusive be held responsible or liable, directly or indirectly, for any loss or damages caused or alleged to have been caused by use of or reliance on any content, goods or services available on such sites. Any concerns regarding any external link should be directed to its respective site administrator or webmaster.You agree to indemnify and hold Small Cap Exclusive, its officers, directors, owners, agents and employees, harmless from any claim or demand, including reasonable attorneys fees, made by any third party due to or arising out of your use of the website, the violation of these Terms of Use by you, or the infringement by you, or other user of the website using your computer, of any intellectual property or other right of any person or entity. We reserve the right, at our own expense, to assume the exclusive defense and control of any matter otherwise subject to indemnification.Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, WFLD. Small Cap Exclusive has been hired by Civit Digital for a period beginning on December 17, 2021 to publicly disseminate information about (WFLD) via website and email. We have been compensated $37,870. We will update any changes to our compensation.Third Parties paying us to market the Profiled Issuer we believe intend to sell their shares they hold while we tell investors to purchase during the Campaign. WFLD is a penny stock that was illiquid (little to no trading volume) prior to our Campaign, and therefore these securities are subject to wide fluctuations in trading price and volume. During the Campaign the trading volume and price of the securities of each Profile Issuer will likely increase significantly because of the media exposure. When the Campaign ends, the volume and price of the Profiled Issuer will likely decrease dramatically. As a result, investors who purchase during the Campaign and hold shares of the Profiled Issuer when the Campaign ends will probably lose most, if not all, of their investment.The Information we publish in the Campaign is only a snapshot that provides only positive information about the Profiled Issuers. The Information consists of only positive content. We do not and will not publish any negative information about the Profiled Issuers; accordingly, investors should consider the Information to be one-sided and not balanced, complete, accurate, truthful and / or reliable. We do not verify or confirm any portion of the Information. We do not conduct any due diligence, nor do we research any aspect of the Information including the completeness, accuracy, truthfulness and / or reliability of the Information. We do not review the Profiled Issuers’ financial condition, operations, business model, management or risks involved in the Profiled Issuer’s business or an investment in a Profiled Issuer’s securities.All information in our Campaign is publicly available information from 3rd party sources and / or the Profiled Issuers and/or the 3rd parties that hire us. We may also obtain the Information from publicly available sources such as the OTC Markets, Google, NASDAQ, NYSE, Yahoo, Bing, the Securities and Exchange Commission’s Edgar database or other available public sources.We select the stocks we profile and / or pick as we are compensated to advertise them. If an investor relies solely on the Information in making an investment decision it is highly probable that the investor will lose most, if not all, of his or her investment. Investors should not rely on the Information to make an investment decision.The source of our compensation varies depending upon the particular circumstances of the Campaign. In certain cases, we are compensated by the Profiled Issuers, third party shareholders, and / or other parties related to the Profiled Issuers such as officers and/or directors who will derive a financial or other benefit from an increase in the trading price and/or volume of a Profiled Issuer’s securities.We make no warranty and / or representation about the Information, including its completeness, accuracy, truthfulness or reliability and we disclaim, expressly and implicitly, all warranties of any kind, including whether the Information is complete, accurate, truthful, or reliable and as such, your use of the Information is at your own risk. The Information is provided as is without limitation.We are not, and do not act in the capacity of any of the following; as such, you should not construe our activities as involving any of the following: an independent adviser or consultant; a fortune teller; an investment adviser or an entity engaging in activities that would be deemed to be providing investment advice that requires registration either at the federal and / or state level; a broker-dealer or an individual acting in the capacity of a registered representative or broker; a stock picker; a securities trading expert; a securities researcher or analyst; a financial planner or one who engages in financial planning; a provider of stock recommendations; a provider of advice about buy, sell or hold recommendations as to specific securities; or an agent offering or securities for sale or soliciting their purchase.There are numerous risks associated with each Profiled Issuer and investors should undertake a full review of each Profiled Issuer with the assistance of their financial, legal, and tax advisers prior to purchasing the securities of any Profiled Issuer.We are not objective or independent and have multiple conflicts of interest. The Profiled Issuers and parties hiring us have conflicts of interest. Third parties that have hired us and own shares will sell these shares while we tell investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.Our publication of the Information involves actual and material conflicts of interest including but not limited to the fact that we receive monetary compensation in exchange for publishing the (favorable) Information about the Profiled Issuers; and we do not publish any negative information, whatsoever, about the Profiled Issuers; in addition to the fact that while we do not own the Profiled Issuer’s securities, the third parties that hired us do, and intend to sell all of these securities during the Campaign while we publish favorable information that instructs investors to purchase, and this selling of the Profiled Issuer’s securities will likely cause investors to suffer losses.We are not responsible or liable for any person’s use of the Information or any success or failure that is directly or indirectly related to such person’s use of the Information because we have specifically stated that the information is not reliable and should not be relied upon for any purpose. We are not responsible for omissions and / or errors in the Information and we are not responsible for actions taken by any person who relies upon the Information.We urge Investors to conduct their own in-depth investigation of the Profiled Issuers with the assistance of their legal, tax and / or investment adviser(s). An investor’s review of the Information should include but not be limited to the Profiled Issuer’s financial condition, operations, management, products and / or services, trends in the industry and risks that may be material to the profiled Issuer’s business and other information he and his advisers deem material to an investment decision. An investor’s review should include, but not be limited to a review of available public sources and information received directly from the Profiled Issuers or from websites such as Google, Yahoo, Bing, OTC Markets, NASDAQ, NYSE, www.sec.gov or other available public sources.We are providing you with this disclaimer because we are publishing advertisements about penny stocks. Because we are paid to disseminate the Information to the public about securities, we are required by the securities laws including Section 10(b) of the Securities Exchange Act of 1934 (the “Exchange Act”) and Rule 10b-5 thereunder, and Section 17(b) of the Securities Act of 1933, as amended (the “Securities Act”), to specifically disclose my compensation as well as other important information, This information includes that we may hold, as well as purchase and sell, the securities of a Profiled Issuer before, during and after we publish favorable Information about the Profiled Issuer. We may urge investors to purchase the securities of a Profiled Issuer while we sell my own shares. The anti-fraud provisions of federal and state securities laws require us to inform you that we may engage in buying and selling of Profiled Issuer’s securities before, during and after the Campaigns.Any investment in the Profiled Issuers involves a high degree of risk and uncertainty. The securities may be subject to extreme volume and price volatility, especially during the Campaigns. Favorable past performance of a Profiled Issuer does not guarantee future results. If you purchase the securities of the Profiled Issuers, you should be prepared to lose your entire investment. Some of the risks involved in purchasing securities of the Profiled Issuers include, but are not limited to the risks stated below.We do not endorse, independently verify or assert the truthfulness, completeness, accuracy or reliability of the Information. We conduct no due diligence or investigation whatsoever of the Information or the Profiled Issuers and we do not receive any verification from the Profiled Issuer regarding the Information we disseminate.If we publish any percentage gain of a Profiled Issuer from the previous day close in the Information, it is not and should not be construed as an indication that the future stock price or future operational results will reflect gains or otherwise prove to be advantageous to your investment.The Information may contain statements asserting that a Profiled Issuer’s stock price has increased over a certain period of time which may reflect an arbitrary period of time, and is not predictive or of any analytical quality; as such, you should not rely upon the (favorable) Information in your analysis of the present or future potential of a Profiled Issuer or its securities.The Information should not be interpreted in any way, shape, form or manner whatsoever as an indication of the Profiled Issuer’s future stock price or future financial performance.You may encounter difficulties determining what, if any, portions of the Information are material or non-material, making it all the more imperative that you conduct your own independent investigation of the Profiled Issuer and its securities with the assistance of your legal, tax and financial advisor.When 3rd parties that hire us acquire, purchase and / or sell the securities of the Profiled Issuers, it may (a) cause significant volatility in the Profiled Issuer’s securities; (b) cause temporary but unrealistic increases in volume and price of the Profiled Issuer’s securities; (c) if selling, cause the Profiled Issuer’s stock price to decline dramatically; and (d) permit themselves to make substantial profits while investors who purchase during the Campaign experience significant losses.The securities of the Profiled Issuers are high risk, unstable, unpredictable and illiquid which may make it difficult for investors to sell their securities of the Profiled Issuers.We may hire third party service providers and stock promoters to electronically disseminate live news regarding the Profiled Issuers, yet we have no control over the content of and do not verify the information that the Profiled Issuers and/or third party service providers publish. These third party service providers are likely compensated for providing positive information about the Issuer and may fail to disclose their compensation to you.If a Profiled Issuer is a SEC reporting company, it could be delinquent (not current) in its periodic reporting obligations (i.e., in its quarterly and annual reports), or if it is an OTC Markets Pink Sheet quoted company, it may be delinquent in its Pink Sheet reporting obligations, which may result in OTC Markets posting a negative legend pertaining to the Profiled Issuer at www.otcmarkets.com, as follows: (i) “Limited Information” for companies with financial reporting problems, economic distress, or that are unwilling to file required reports with the Pink Sheets; (ii) “No Information,” which characterizes companies that are unable or unwilling to provide any disclosure to the public markets, to the SEC or the Pink Sheets; and (iii) “Caveat Emptor,” signifying buyers should be aware that there is a public interest concern associated with a company’s illegal spam campaign, questionable stock promotion, known investigation of a company’s fraudulent activity or its insiders, regulatory suspensions or disruptive corporate actions.If the Information states that a Profiled Issuer’s securities are consistent with the future economic trends or even if your independent research indicates that, you should be aware that economic trends have their own limitations, including: (a) that economic trends or predictions may be speculative; (b) consumers, producers, investors, borrowers, lenders and/or government may react in unforeseen ways and be affected by behavioral biases that we are unable to predict; (c) human and social factors may outweigh future economic trends that we state may or will occur; (d) clear cut economic predictions have their limitations in that they do not account for the fundamental uncertainty in economic life, as well as ordinary life; (e) economic trends may be disrupted by sudden jumps, disruptions or other factors that are not accounted for in economic trends analysis; in other words, past or present data predicting future economic trends may become irrelevant in light of new circumstances and situations in which uncertainty becomes reality rather than predicted economic outcome; or (f) if the trend predicted involves a single result, it ignores other scenarios that may be crucial to make a decision in the event of unknown contingencies.The Information is presented only as a brief snapshot of the Profiled Issuer and should only be used, at most, and if at all, as a starting point for you to conduct a thorough investigation of the Profiled Issuer and its securities. You should consult your financial, legal or other adviser(s) and avail yourself of the filings and information that may be accessed at www.sec.gov, www.otcmarkets.com or other electronic media, including: (a) reviewing SEC periodic reports (Forms 10-Q and 10-K), reports of material events (Form 8-K), insider reports (Forms 3, 4, 5 and Schedule 13D); (b) reviewing Information and Disclosure Statements and unaudited financial reports filed with the OTCMarkets.com; (c) obtaining and reviewing publicly available information contained in commonly known search engines such as Google; and (d) consulting investment guides at www.sec.gov and www.finra.org. You should always be cognizant that the Profiled Issuers may not be current in their reporting obligations with the SEC and the OTC Markets and/or have negative legends and designations at otcmarkets.com.No securities commission or other regulatory authority in Canada or any other country or jurisdiction has in any way passed upon this information and no representation or warranty is made by to that effect. The information is not a substitute for independent professional advice before making any investment decisions. The CSE (Canadian Securities Exchange) has not reviewed the information in this Article and does not accept responsibility for the adequacy or accuracy of it.Small Cap Exclusive, reserves the right, at its sole discretion, to change, modify, add and/ or remove all or part of this Disclaimer and / or Terms of Use at any time.

Quick Takes: Market Research on VLON, ALF and BTB

Company Snapshot

Company Name: Vallon Pharmaceuticals, Inc.

Ticker: (VLON)

Exchange: NASDAQ

Website: www.vallon-pharma.com

Company Summary:

Vallon Pharmaceuticals, Inc. is a clinical-stage biopharmaceutical company, headquartered in Philadelphia, PA. The Company is focused on the development of new medications to help patients with CNS disorders. The Company’s lead investigational product candidate, ADAIR, is a novel abuse deterrent formulation of amphetamine immediate release being developed for the treatment of ADHD and narcolepsy.

Why did it go up over 100%?

Vallon Pharmaceuticals, Inc. reported its financial results for the quarter ended September 30, 2021.

Also announced, ADAIR is the Company’s proprietary abuse-deterrent formulation of immediate-release dextroamphetamine currently in development for the treatment of attention deficit hyperactivity disorder (ADHD) and narcolepsy. ADAIR is being developed leveraging the de-risked 505(b)(2) regulatory pathway and is currently being evaluated in the SEAL study, a pivotal intranasal abuse study. If approved, ADAIR has the potential to address the growing Adderall® segment of the ~$9 billion US ADHD market.

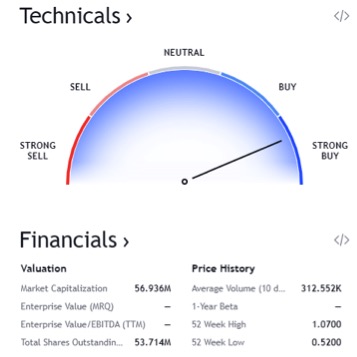

Technical Analysis:

Anytime there is a big spike in price action there normally is a pull back, the whole adage, what goes up must comes down takes over. In the first chart you can see an obvious spike of over 100% with a pull back. How far will it pull back, that is speculation but right now we know it is pulling back. In the second chart you can see the pull back/sell off is still supported around $6.50 which is promising for the future. Make sure it stays above $6.10.

Company Snapshot

Company Name: Bit Brother Limited

Ticker: (BTB)

Exchange: NASDAQ

Website: https://bitbrothers.in/

Company Summary:

A team of experienced data scientists, data engineers, developers and designers, ready to help you build your web and mobile application

Why did it go up over 100%?

Bit Brother Limited share price is up 86% in the last month. But has been plagued with 5 years of declines. So why has it started to bounce back? Big News? No. The only reason we see for the increase is a modest increase in revenue which means this stock should not be increasing share price as much as it has in this month based on the modest increases in revenue. Be aware!

Technical Analysis:

Bit Brother Limited share price is in worse shape than it was before the massive run of over 150% with nominal news. We see this everyday in the market, stocks get over bought and then without fail, the stocks come plumitting. This is no different and we are not optimistic in the short term with Bit Brother.

Company Snapshot

Company Name: Alfi, Inc.

Ticker: (ALF)

Exchange: NASDAQ

Website: https://www.getalfi.com/about-us/

Company Summary:

Alfi, Inc. engages in creating interactive digital out-of-home advertising experiences. Alfi utilizes artificial intelligence and computer vision to better serve ads to people. Alfi’s proprietary Ai algorithm understands small facial cues and perceptual details that make potential customers a good candidate for a particular product.

Why did it go up over 100%?

The Schall Law Firm, a national shareholder rights litigation firm, announces that it is investigating claims on behalf of investors of Alfi, Inc. (“Alfi” or “the Company”) (NASDAQ: ALF) for violations of the securities laws.

Technical Analysis

Stay away, well, because it is a garbage chart with no foreseeable rebound. Moreover, it is very strange that Alfi ran after the news, nothing makes sense with this stock!

Spotlite360 Secures Agreement with One of Colorado’s Longest-Established Cannabis Dispensary Operators to Facilitate Planned Multi-State Expansion

Read original article here.

DENVER and VANCOUVER, British Columbia, Aug. 11, 2021 (GLOBE NEWSWIRE) — SPOTLITE360 TECHNOLOGIES, INC. (“Spotlite360” or the “Company”) (CSE: LITE) (OTC: SPLTF) (Frankfurt: 87A) is pleased to announce that it has entered into a master terms agreement (the “Agreement”) with Peak Dispensary (“Peak”), a cannabis dispensary operator with locations in Denver and Sedgwick, Colorado, to develop scopes of work for the integration of the Company’s suite of technologies (the “Spotlite360 Technologies”) into Peak’s systems as part of its business objectives. At this time, Peak is planning an expansion into at least five new states which are likely to present complex regulatory challenges in each jurisdiction. Additionally, the ability of the Spotlite360 Technologies to track provenance of goods in the supply chain could prove instrumental to its ability to maintain product and brand integrity in the course of such expansions.

Shortly before announcing a licensing agreement with a Colorado-based hemp manufacturer in a July 29, 2021 press release, the Company released a video presentation by its President James Greenwell detailing the applications of the Spotlite360 Technologies in the cannabis industry. In a CNBC op-ed last month, technology was recognized as the driver of growth opportunities in the cannabis industry to fill gaps left by traditional enterprise solutions. Although such technologies are suitable for businesses that are subject to lower regulatory burdens with less expansive inventories (e.g., a restaurant with 30 menu items), cannabis dispensaries in the United States are regulated to a much greater degree and commonly stock hundreds or thousands of product varieties. For instance, although cannabis edibles can carry more than 134 different attributes such as strains and ingredients, there is no normalized data collection process for this type of information1. Through a combination of blockchain and Internet-of-Things (“IoT”) capabilities, the Spotlite360 Technologies can allow for this data to be gathered efficiently and transmitted proactively to suit the increasingly sophisticated needs of the cannabis industry.

Under the scope of work contemplated in the Agreement, Peak intends to leverage the Spotlite360 Technologies to improve visibility into the movement of its products through the supply chain both to create new business value and to diligently comply with the unique regulations in each new state in which it plans to operate. Peak has also contract grown more than 50 unique strains of cannabis, several of which are award-winning, and has recognized the benefits of using IoT sensors (e.g., for temperature and humidity) for the purposes of optimizing product quality and preventing losses from damage or mishandling.

As an early-stage player in the cannabis industry with the fourth dispensary license ever issued in the state of Colorado, Peak believes that the Spotlite360 Technologies can play a role in fortifying its reputation as a world-class purveyor of cannabis products. The visitor traffic to Peak’s Denver location in April of 2015 on the days surrounding the annual April 20 cannabis culture celebration (popularly known as “420”) was highlighted in a Business section article of the Denver Post later that year, which included 82 buses and 17 limousines in a four-day period2. Furthermore, Peak has enjoyed considerable media attention from several well-known outlets, which can be viewed on Peak’s Media webpage: http://peakmj.com/media/

A photo accompanying this announcement is available athttps://www.globenewswire.com/NewsRoom/AttachmentNg/74e92a47-8f6c-4c43-8287-fc5bc63066a3

In the third episode of “In My City: Denver”, a series produced by HipHopDX (a channel owned by Warner Music Group), Peak was featured as an iconic contributor to Denver’s music scene, with patronage from high-profile recording artists. This episode can be viewed by clicking the thumbnail above or by clicking here.

Readers using news aggregation services may be unable to view the media above. Please access SEDAR for a version of this press release containing all published media.

Spotlite360 President James Greenwell commented, “Accountability is the name of the game in the cannabis industry in 2021. In markets across the country, industry players are facing all kinds of questions from customers, suppliers, and regulators, and it is mandatory to have the right answers. As evidenced by last month’s CNBC article, weaknesses in legacy technologies for users in the cannabis industry are coming to the surface given the space’s unique nuances compared to other sectors. Blockchain and IoT technologies can each contribute to providing unprecedented value to firms in the cannabis industry, particularly in out-of-state expansions such as those presently being planned by Peak. We are pleased to have entered into this agreement with such an established and well-regarded cannabis dispensary operator here in our home state, and we look forward to maximizing their potential through the use of the Spotlite360 Technologies.”

Sources

On behalf of the Board of Directors of the Company,

Spotlite360 Technologies Inc.

“James Greenwell”

James Greenwell, President

For more information about Spotlite360, please visit: http://spotlite360.com

Charles LeeInvestor Relations and Media Inquiries+1 (720) 830-6120[email protected]

THE CANADIAN SECURITIES EXCHANGE (“CSE”) HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ACCURACY OR ADEQUACY OF THIS RELEASE, NOR HAS OR DOES THE CSE’S REGULATION SERVICES PROVIDER.

About Spotlite360 Technologies Inc.

Spotlite360 is a logistics technologies solutions provider unlocking value, opportunities, and efficiencies for all participants in a supply chain. Building upon existing applications of IoT technologies, distributed ledgers, and machine learning, Spotlite360 endeavours to set new standards of transparency, integrity, and sustainability in the pharmaceutical, healthcare, and agriculture industries. As regulators across the globe begin to impose new tracing and accountability requirements for the protection of consumers (e.g., DSCSA and FSMA from the U.S. Food and Drug Administration), the need for reliable, cost-effective, and versatile tracking technology is expected to grow considerably. Spotlite360’s flagship SaaS solution has been engineered to seamlessly track the movement of a product by integrating with systems of all major stakeholders in a supply chain ranging from the raw materials to the hands of the end consumer. With a primary objective of onboarding new clients in 2021, Spotlite360 plans to explore innovative use cases for its proprietary stack of technologies which could transform logistics workflows in some of the world’s largest industries.

Forward-Looking Statements

This news release contains “forward-looking information” within the meaning of applicable Canadian securities legislation, with respect to the Company. The forward-looking information included in this news release is not based on historical facts, but rather on the expectations of the Company’s management regarding the future growth of the Resulting Issuer, its results of operations, performance, business prospects, and opportunities. This news release uses words such as “will”, “expects”, “anticipates”, “intends”, “plans”, “believes”, “estimates”, or similar expressions to identify forward-looking information. Such forward-looking information reflects the current beliefs of the Company’s management, based on information currently available to them.

This forward-looking information includes, among other things, statements relating to: the intentions, plans and future actions of the Company; statements relating to the business and future activities of the Company; anticipated developments in operations of the Company; market position, ability to compete, and future financial or operating performance of the Company; the timing and amount of funding required to execute the business plans of the Company; capital expenditures of the Company; the effect on the Company, of any changes to existing or new legislation or policy or government regulation; the length of time required to obtain permits, certifications and approvals; the availability of labour; estimated budgets; currency fluctuations; requirements for additional capital; limitations on insurance coverage; the timing and possible outcome of regulatory and permitting matters; goals; strategies; future growth; the adequacy of financial resources; our expectations regarding revenues, expenses and anticipated cash needs.

In addition, any statements that refer to expectations, intentions, projections or other characterizations of future events or circumstances contain forward-looking information. Forward-looking statements are based on certain assumptions and analyses made by the Company in light of the experience and perception of historical trends, current conditions, and expected future developments and other factors it believes are appropriate, and are subject to risks and uncertainties. Although the Company believes that the assumptions underlying these statements are reasonable, they may prove to be incorrect, and there can be no assurance that actual results will be consistent with these forward-looking statements. Given these risks, uncertainties, and assumptions, prospective investors should not place undue reliance on these forward-looking statements. Whether actual results, performance, or achievements will conform to the expectations and predictions of the Company is subject to a number of known and unknown risks, uncertainties, assumptions, and other factors, including those listed in the Company’s non-offering prospectus dated May 26, 2021.

If any of these risks or uncertainties materialize, or if assumptions underlying the forward-looking statements prove incorrect, actual results might vary materially from those anticipated in the forward-looking statements. Information contained in forward-looking statements in this news release is provided as of the date of this news release, and the Company disclaims any obligation to update any forward-looking statements, whether as a result of new information or future events or results, except to the extent required by applicable securities laws. Accordingly, potential investors should not place undue reliance on forward-looking statements or the information contained in those statements.

All of the forward-looking information contained in this news release is expressly qualified by the foregoing cautionary statements.

Statement Regarding Third-Party Investor Relations Firms

Disclosures relating to investor relations firms retained by Spotlite360 Technologies Inc. can be found under the Company’s profile on http://sedar.com.

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, SpotLite360. Small Cap Exclusive has been hired by SpotLite360 for a period beginning on July 10, 2021 for 3 months to publicly disseminate information about SpotLite360 via website and email. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

SpotLite360 (CSE-LITE) made Huge gains since trading began, and could continue trending uphill.

Put LITE on your Watchlist NOW

3 Critical Events Have Made SpotLite360 the Darling of the Canadian Securities Exchange!

Here are the 3 critical events that could forever change supply chain technology!

- The chart is on fire!

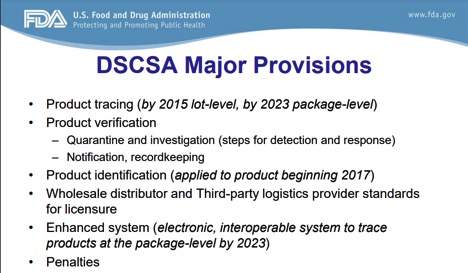

- In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

- The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

Company Name: SpotLite360

Ticker: CSE-LITE

Company Summary: SpotLite360 is a SaaS-based, enterprise software company leveraging IoT technologies, blockchain, & machine learning to deliver supply chain solutions which result in improved tracing, tracking, visibility, efficiency, collaboration & proof of sustainability claims for customers within pharmaceutical, healthcare & agriculture.

What do they do?

In lay terms, they develop software that improves tracing, tracking, visibility, efficiency, collaboration & proof of sustainability claims for customers within pharmaceutical, healthcare & agriculture. SpotLite360’s software allows companies to have a real-time view of inventory all over the world with a click of a mouse! Imagine if this software or software like it, was mandatory? The pandemic would have been way different, we would have had toilet paper, LOL!

#1. The trading for LITE is in an aggressive bullish trend with possibly no end in sight, producing 100% gains in a month!

As you can see in this chart found above, this stock is absolutely trending extremely bullish. All indicators are positive and likely to continue in this upward trend line. In regards to the technicals, it is a STRONG BUY! 7

#2. In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

Take a look at this quote by an industry giant in the supply chain management:

Mike Crum, a professor and chair of supply chain management in Iowa State University’s Ivy College of Business was asked, Why is the government an important part of the supply chain?

“The government, through investments, financial incentives, regulations, and policies, greatly [affects] supply chain performance.” 3

It is clear, the writing is on the wall, whether you like it or not big brother is coming with mandates! The libertarians will be sounding the alarm that the police state is being ushered in, the Dems will be cheering the victory and the consumer will be tickled pink when essential goods will be available during the next crisis. As a trader, you have a rare opportunity to profit from big brother’s mandates.

In Big Pharma’s case it’s not if the government will mandate better supply chain technology, it’s when because we have the date!

In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.”

Take a look at this excerpt from the FDA website!

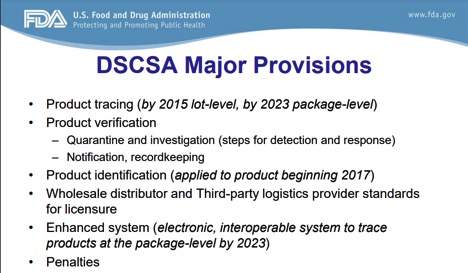

The Drug Quality and Security Act (DQSA), was enacted by Congress on November 27, 2013. Title II of DQSA, the Drug Supply Chain Security Act (DSCSA), outlines steps to build an electronic, interoperable system to identify and trace certain prescription drugs as they are distributed in the United States. 2

Big brother is mandating that pharma companies must follow federal guidelines in regards to certain drugs, this is the reason why:

- More than $1 billion in drug thefts annually

- $236 billion in counterfeit drugs causing harm to the populace

- 25% of vaccines damaged in transit, another result of Covid

- 20% temperature sensitive drugs perish.

These mandates are looming, they are right around the corner and trillion dollar mega-companies will be scrambling to be compliant and SpotLite360 will be knocking on their door with possibly the best solution in the market with decades of experience!

Don’t believe me, this is an excerpt taken from the FDA website.

This will enhance FDA’s ability to help protect consumers from exposure to drugs that may be counterfeit, stolen, contaminated, or otherwise harmful. The system will also improve detection and removal of potentially dangerous drugs from the drug supply chain to protect U.S. consumers.2

The above screen shot was taken from the FDA website.

If the big Pharma mandate by the federal government gets you excited, there are two mandates that will greatly impact SpotLite360! Take a look at this!

#3. The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

Take a look at the following excerpt from the FDA’s website,

“The Drug Quality and Security Act (DQSA), was enacted by Congress on November 27, 2013. Title II of DQSA, the Drug Supply Chain Security Act (DSCSA), outlines steps to build an electronic, interoperable system to identify and trace certain prescription drugs as they are distributed in the United States.” 2

On July 13, 2020, the FDA released the Blueprint for the New Era of Smarter Food Safety. The blueprint outlines the FDA’s vision to enhance traceability, improve predictive analytics, respond more rapidly to outbreaks, address new business models, reduce contamination of food, and foster the development of stronger food safety cultures. Although the FSMA 204 rulemaking is limited to only certain foods, the blueprint identifies it as a foundational first step on the path to promoting tech-enabled end-to-end traceability for all foods. The proposed rule, when finalized, would establish a standardized approach to traceability recordkeeping, paving the way for industry to adopt, harmonize, and leverage more digital traceability systems in the future.

From the FDA’s website, “A modern, coordinated approach to traceability that can be used and understood throughout all stages of the food supply chain will go further to reduce foodborne illness, build consumer trust, and avoid overly-broad recalls.” 5

The federal government is pushing for these laws to ensure safety for its constituents and to respond to the majority who are interested in where their food comes from.

56% of shoppers want to know where their food comes from. 6

Our world, whether we like it or not, is headed towards: organic, lactose free, grass fed, grown in the USA, Kobe, farm raised, cruelty free and so on and so on. As the demand for thoses nomenclatures grow, the demand for the proof of those labels increases too.

56% of shoppers want to know where their food comes from. SpotLite360 (CSE-LITE) specializes in supply chain management via a SaaS platform that can meet the demands of those 56% that are demanding certificate of origin.

FDA is establishing these rules to tackle to avoid these problems:

- Lack of visibility allows opportunities for product tampering and theft

- 68% of consumers will pay more for products that are produced ethically and responsibly

- As much as 60% of all food produced is wasted and never makes it to the consumer ($1 trillion)

- Food-borne pathogens costs consumers $55.5 billion per year

- Food fraud costs the industry $40 billion annually

SpotLite360 is catering to three verticals: agriculture, big pharma and healthcare. Of the three, two have or will have mandates to utilize the technology that SpotLite360 has developed. SpotLite360 will be funding its efforts to penetrate and control as much of the market share via a public offering. We are incredibly excited to share this information with you and highly encourage you to place SpotLite360 on your watchlist TODAY.

As A Quick Recap, the THREE Top Reasons to Put (CSE-LITE) on Your Watchlist Today!

- The chart is on fire!

- FDA announced that they are making it mandatory to identify and trace certain prescription drugs as they are distributed throughout the U.S., that could be worth TRILLION$!

- The FDA has proposed new traceability rules in regards to agriculture, people care about the efficacy of organic food!

3. https://www.futurity.org/supply-chain-us-government-2535692/

4. https://mitsloan.mit.edu/ideas-made-to-matter/post-pandemic-supply-chains-retool-a-new-abnormal

5. https://www.fda.gov/food/new-era-smarter-food-safety/tracking-and-tracing-food

6. https://www.spotlite360.com/investors

7. https://www.tradingview.com/symbols/CSE-LITE/

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, SpotLite360. Small Cap Exclusive has been hired by SpotLite360 for a period beginning on July 10, 2021 for 3 months to publicly disseminate information about SpotLite360 via website and email. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

SpotLite360 Made Huge Gains Since Trading Began in CANADA, NOW is the Time for US Traders

THREE Critical Events Have Made SpotLite360 the Darling of the Canadian Securities Exchange, Now They are Ready to Take on Wall Street!

Here are the 3 critical events that could forever change supply chain technology!

- The chart is on fire!

- In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

- The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

Company Name: SpotLite360

Ticker:

Company Summary: SpotLite360 is a SaaS-based, enterprise software company leveraging IoT technologies, blockchain, & machine learning to deliver supply chain solutions which result in improved tracing, tracking, visibility, efficiency, collaboration & proof of sustainability claims for customers within pharmaceutical, healthcare & agriculture.

SpotLite360 is ready to pounce on this archaic market and establish itself as the market leader of this TRILLION dollar a year industry!

SpotLite360 is a technology company that operates in the supply chain vertical. More importantly, they are in the midst of an IPO (initial public offering). Get ready because this company is poised to possibly make a historic run.

READ THE LATEST NEWS ON SPOTLITE 360 HERE!

What do they do?

In lay terms, they develop software that improves tracing, tracking, visibility, efficiency, collaboration & proof of sustainability claims for customers within pharmaceutical, healthcare & agriculture. SpotLite360’s software allows companies to have a real-time view of inventory all over the world with a click of a mouse! Imagine if this software or software like it, was mandatory? The pandemic would have been way different, we would have had toilet paper, LOL!

The 3 critical events that could forever change supply chain technology!

#1. The chart is on fire!

#2. In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

#3. The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

#1. The chart is in an aggressive bullish trend with no end in sight, producing 100% gains in a month!

As you can see in this chart found above, this stock is absolutely trending extremely bullish. All indicators are positive and likely to continue in this upward trend line. In regards to the technicals, it is a STRONG BUY! 7

#2. In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.” 2

Take a look at this quote by an industry giant in the supply chain management:

Mike Crum, a professor and chair of supply chain management in Iowa State University’s Ivy College of Business was asked, Why is the government an important part of the supply chain?

“The government, through investments, financial incentives, regulations, and policies, greatly [affects] supply chain performance.” 3

It is clear, the writing is on the wall, whether you like it or not big brother is coming with mandates! The libertarians will be sounding the alarm that the police state is being ushered in, the Dems will be cheering the victory and the consumer will be tickled pink when essential goods will be available during the next crisis. As a trader, you have a rare opportunity to profit from big brother’s mandates.

In Big Pharma’s case it’s not if the government will mandate better supply chain technology, it’s when because we have the date!

In 2023, less than 2 years away, the FDA announced that they are making it mandatory to, “identify and trace certain prescription drugs as they are distributed throughout the U.S.”

Take a look at this excerpt from the FDA website!

The Drug Quality and Security Act (DQSA), was enacted by Congress on November 27, 2013. Title II of DQSA, the Drug Supply Chain Security Act (DSCSA), outlines steps to build an electronic, interoperable system to identify and trace certain prescription drugs as they are distributed in the United States. 2

Big brother is mandating that pharma companies must follow federal guidelines in regards to certain drugs, this is the reason why:

- More than $1 billion in drug thefts annually

- $236 billion in counterfeit drugs causing harm to the populace

- 25% of vaccines damaged in transit, another result of Covid

- 20% temperature sensitive drugs perish.

These mandates are looming, they are right around the corner and trillion dollar mega-companies will be scrambling to be compliant and SpotLite360 will be knocking on their door with possibly the best solution in the market with decades of experience!

Don’t believe me, this is an excerpt taken from the FDA website.

This will enhance FDA’s ability to help protect consumers from exposure to drugs that may be counterfeit, stolen, contaminated, or otherwise harmful. The system will also improve detection and removal of potentially dangerous drugs from the drug supply chain to protect U.S. consumers.2

The above screen shot was taken from the FDA website.

If the big Pharma mandate by the federal government gets you excited, there are two mandates that will greatly impact SpotLite360! Take a look at this!

#3. The FDA has proposed new traceability rules on critical tracking supply chain activities to combat the food fraud costs the industry $40 billion annually and the food-borne pathogens costs of $55.5 billion per year!

Take a look at the following excerpt from the FDA’s website,

“The Drug Quality and Security Act (DQSA), was enacted by Congress on November 27, 2013. Title II of DQSA, the Drug Supply Chain Security Act (DSCSA), outlines steps to build an electronic, interoperable system to identify and trace certain prescription drugs as they are distributed in the United States.” 2

On July 13, 2020, the FDA released the Blueprint for the New Era of Smarter Food Safety. The blueprint outlines the FDA’s vision to enhance traceability, improve predictive analytics, respond more rapidly to outbreaks, address new business models, reduce contamination of food, and foster the development of stronger food safety cultures. Although the FSMA 204 rulemaking is limited to only certain foods, the blueprint identifies it as a foundational first step on the path to promoting tech-enabled end-to-end traceability for all foods. The proposed rule, when finalized, would establish a standardized approach to traceability recordkeeping, paving the way for industry to adopt, harmonize, and leverage more digital traceability systems in the future.

From the FDA’s website, “A modern, coordinated approach to traceability that can be used and understood throughout all stages of the food supply chain will go further to reduce foodborne illness, build consumer trust, and avoid overly-broad recalls.” 5

The federal government is pushing for these laws to ensure safety for its constituents and to respond to the majority who are interested in where their food comes from.

56% of shoppers want to know where their food comes from. 6

Our world, whether we like it or not, is headed towards: organic, lactose free, grass fed, grown in the USA, Kobe, farm raised, cruelty free and so on and so on. As the demand for thoses nomenclatures grow, the demand for the proof of those labels increases too.

56% of shoppers want to know where their food comes from. SpotLite360 specializes in supply chain management via a SaaS platform that can meet the demands of those 56% that are demanding certificate of origin.

FDA is establishing these rules to tackle to avoid these problems:

- Lack of visibility allows opportunities for product tampering and theft

- 68% of consumers will pay more for products that are produced ethically and responsibly

- As much as 60% of all food produced is wasted and never makes it to the consumer ($1 trillion)

- Food-borne pathogens costs consumers $55.5 billion per year

- Food fraud costs the industry $40 billion annually

SpotLite360 is catering to three verticals: agriculture, big pharma and healthcare. Of the three, two have or will have mandates to utilize the technology that SpotLite360 has developed. SpotLite360 will be funding its efforts to penetrate and control as much of the market share via a public offering. We are incredibly excited to share this information with you and highly encourage you to place SpotLite360 on your watchlist TODAY.

As A Quick Recap, the THREE Top Reasons to Put SpotLite360 on Your Watchlist Today!

- The chart is on fire!

- FDA announced that they are making it mandatory to identify and trace certain prescription drugs as they are distributed throughout the U.S., that could be worth TRILLION$!

- The FDA has proposed new traceability rules in regards to agriculture, people care about the efficacy of organic food!

3. https://www.futurity.org/supply-chain-us-government-2535692/

4. https://mitsloan.mit.edu/ideas-made-to-matter/post-pandemic-supply-chains-retool-a-new-abnormal

5. https://www.fda.gov/food/new-era-smarter-food-safety/tracking-and-tracing-food

6. https://www.spotlite360.com/investors

7. https://www.tradingview.com/symbols/CSE-LITE/

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, SpotLite360. Small Cap Exclusive has been hired by SpotLite360 for a period beginning on July 10, 2021 for 3 months to publicly disseminate information about SpotLite360 via website and email. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

Hunter Technology (HOILF) Stock Is Moving in the Right Direction: Here is Why

When a stock gains momentum over several days, then it might be a good move for investors to start taking a closer look into the stock and the company. The Hunter Technology Corp. (OTCMKTS-HOILF) stock has been gaining considerable momentum in recent days and that might have been related to an updated shared by the company last week.

The company, which is involved in the development of global digital marketplaces focused on the worldwide energy trading industry, provided an update on the progress that it has made with regards to the development of its latest offering OilExchange. Hunter Technology also provided an update on the latest investor deck in relation to this product.

It is a highly innovative product and is meant to act as a platform that is going to help sovereign clients with oil supply chain intelligence solutions. However, that is not all. There are some other highly important features that ought to be pointed out.

The oil value chains can be highly complex but the OilExchange platform is capable of providing large oil producers and governments with the necessary transparency that is so necessary. The oil value chain is highly complex and OilExchange provides solutions starting from the stage of production to trade and storage.

The company announced that it is currently on course to come up with the first version of the product at some point in the third quarter of 2021. However, more importantly, the company revealed that it has engaged with regulatory agencies, governments and a range of selected potential customers in relation to OilExchange.

The interactions have proven that the product could have significant market potential when it is eventually launched. The oil industry is massive and oil trading is the bread and butter of some of the biggest oil companies in the world. Hence, it is a product that could bring a lot of value. Investors could do well to keep an eye on Hunter Technologies from now on.

Disclaimer

Small Cap Exclusive is owned and operated by JBN PARTNERS LLC, which is a US based corporation. We are paid advertisers, also known as stock touts or stock promoters, who disseminate favorable information (this “Article”) about publicly traded companies (the “Profiled Issuers”).

We publish the Information on our website, smallcapexclusive.com and in newsletters, text message alerts, audio services, live interviews, featured “research” reports, on message boards and in email communications for specific time periods that are agreed upon between us and the Profiled Issuer and / or third party paying us. Our publication of the Information is known as a “Campaign”. This information may be sent to potential investors at different times that are minutes, hours, days or even weeks apart. Typically, the trading volume and price of a Profiled Issuer’s securities increases after the information is provided to the first group of investors. Therefore, the later an investor receives the Information, the more likely it is that he will suffer trading losses if they purchase the securities of a Profiled Issuer late in a Campaign. We are paid to advertise the Profiled Issuers, Hunter Technology Small Cap Exclusive has been hired by Star Finance GMBH, Turmstrasse 28,6312 Stenhausen (ZG), Switzerland for a period beginning on June 1, 2021 to publicly disseminate information about (HOILF) via website, email, as well as outside service providers. We have been compensated $50,000 USD. We will update any changes to our compensation.

Read full disclaimer here.

All Eyes on FACT (OTC-FCTI) – The Only Company Fighting This $6 Billion Fraud Market Just Went Public

The Devil is in the details and this IPO is a Tech Company that examines a multibillion-dollar industry on the microscopic level! What does this company actually do? F.A.C.T, (OTC-FCTI) is the ONLY PORTABLE SOLUTION ON THE MARKET that uses technology to create a “Digital Fingerprints” from the Physical Artwork for Verification and Condition Reporting. Why is this technology so exciting for investors? The art fraud market is estimated by the FBI to be a $6B industry! FACT has positioned itself, with the above mentioned technology, to possibly be the dominant force in the art fraud prevention vertical, which is again a $6B industry. Who are their competitors? The first two questions ask, what do they do and how big is the market. The final question is, who will they be competing with to possibly gain control of this $6B a year industry? Their competition is “art experts” who verify paintings with the naked eye! This process is archaic and ripe with fraud and FACT has made it their mission to solve this dilemma via cutting-edge technology.

6 Reasons why F.A.C.T,(OTC-FCTI) Forensic Art Certification Technology is the IPO to watch and that is a FACT!

1. Numbers don’t lie, and the potential profit is possibly explosive!

I literally did about 20 minutes of research and my jaw hit the floor! It is rare to find a market that is worth so much internationally so antiquated in technology! Furthermore, to find the same industry boasting $6B in annual sales is when the hairs on the back of my neck stood up at attention like a WW2 soldier. Take a look at this quote from Statista.com, “This increase is also shown in the volume of global art sales which reached approximately 40 million transactions in 2018” LINK I rubbed my eyes and thought, 40 million transactions?!?! If FACT was just to capture 10% of the market share, which is possibly silly when you consider how far superior their technology in comparison to their competition, that’s $6B! So, if they capture 10% of a 40,000,000 transactions would equal 4,000,000 transactions! What could the revenue look like for (OTC-FCTI) if they were able to capture 10%? Here is a local “art expert” that reviews the piece with his/her naked eye and charges $150, with no technology! LINK 4,000,000 authenticating transactions X $150 = $600,000,000! Annually Their competition is a local “art expert” who evaluates the art with their naked eye and then authenticates the art with a piece of paper called a COA. That is it! Imagine if there was a machine that uses a computer algorithm to verify authenticity down to a size smaller than a grain of sand?!?! Well there is and we are excited. Is that worth $150, $300 or $600?!?! Will they penetrate 10%, 15% or 20% of the market? Let’s be honest, even in the worst case scenario, that is $600 Million US Dollars annually!

2. FACT has developed/redesignated a technology that is truly pioneering in the art authentication industry.

F.A.C.T, (OTC: FCTI), Secured Device is the ONLY PORTABLE SOLUTION ON THE MARKET that uses technology to create a “Digital Fingerprints” from the Physical Artwork for Verification and Condition Reporting. They have adapted the same forensic ballistics technology used by global law enforcement agencies to the art world! An “interferometer’ – a high tech machine – captures a scan of the painting down to 1/50th the size of a human hair. Right down to the pressure on an artist’s brush stroke! Current scans are compared to previous scans by a high tech computer generated algorithm to make sure that it is the same painting! This creates a Tangible Links between the Owner, Artwork and Database Record through Identification of a “Digital Fingerprint” from the Scans. LINK (Investor Deck on the website). I apologize for typing in caps above but that is an especially important concept that the average investor needs to play close attention. The current industry standard is “art experts” certifying with their naked eye that it’s the original, with their naked eye, with the possibility of Millions of dollars on the line. This archaic method lends itself to fraud because technology has outpaced the human eye. The art fraud market is estimated by the FBI to be a $6B industry! In fact, an expert in the field, 9Mousai founder, Richard Hammond, offers some advice: “A certificate of authenticity is essential when buying and selling art to prove legitimacy,” he reveals. “The certificate must be signed by the artists or a representative or it isn’t worth the paper it’s printed on, and there are fakes around, so beware.” LINK Let me repeat, there are fakes around, not anymore. FACT will literally revolutionize the art authenticating landscape forever. Investors are you excited? Everyone is excited for this IPO, except for art criminals, they are petrified!

[video width="1280" height="720" mp4="https://smallcapexclusive.com/wp-content/uploads/2020/11/FACT-Finance-v-04-29-10-2020.mp4" loop="true" autoplay="true" preload="auto"][/video]3. Its groundbreaking technology is positioned in a $6B industry with no market leaders!

What other $10B+ industry has no clear-cut industry titan that dominates it, none that I can think of. This technology will become the gold standard of the art verification world and that world is worth $6B! No other verification system uses technology and the actual painting! For comparison purposes, the online dating industry is a $3 billion dollar a year industry! LINK Let’s take a minute to digest that research. In the example above, if FACT can capture 15% of the market at a $600 service fee, they will produce revenue in excess of $3 BILLION! However, there is no Ok Cupid in the space! No Bumble! No Tinder! Just a vacuum of opportunity with no competitors! A bunch of Ma and Pa stores before the advent of Walmart.

4. It’s an IPO with groundbreaking technology in a $6B industry with no market leader. Yes I repeated myself, because you should pay attention!

It’s an IPO, ground floor opportunity in a brand-new technology in a multibillion-dollar industry. I could do the easy lay up here and compare it to all the crazy IPOS which had 300%, 800%, and 1,200% gains but that is just too easy! As savvy investors we have heard all those war stories and for me that would feel like I lost a little bit of my soul by going somewhere so transparent. So, I will keep this point short and sweet and remind you for a third time, it’s an IPO with groundbreaking technology in a $6B industry with no market leader!

5. Do I have your attention now? If I don’t, I will when you find out that they have multiple ways to monetize the hardware and software!