Leading Edge Materials LEMIF hits 52 week high!

Company Name: Leading Edge Materials Corp.

Ticker: (LEMIF)

Exchange: OTC

Website: www.leadingedgematerials.com

Company Summary:

Leading Edge Materials is a Canadian public company focused on developing a portfolio of critical raw material projects located in the European Union. Critical raw materials are determined as such by the European Union based on their economic importance and supply risk. They are directly linked to high growth technologies such as batteries for electromobility and energy storage and permanent magnets for electric motors and wind power that underpin the clean energy transition towards climate neutrality. The portfolio of projects includes the 100% owned Woxna Graphite mine (Sweden), Norra Karr HREE project (Sweden) and the 51% owned Bihor Sud Nickel Cobalt exploration alliance (Romania).

Why did it go up over 100%?

October 6, 2021 – Leading Edge Materials Corp. announce that its 100% owned Swedish subsidiary Woxna Graphite AB (“Woxna”) has signed a non-binding Heads of Agreement (the “MOU”) with Sydney, Australia, based Sicona Battery Technologies Pty Ltd (“Sicona”). The MOU lays out the path for the establishment of a Sweden based 50/50 Joint Venture (the “JV”) targeting the production of advanced natural graphite and silicon-graphite-carbon composite active anode materials using natural graphite from the Woxna Graphite mine as feedstock to offer the European lithium-ion battery manufacturing industry a secure and sustainable supply of high-performance anode materials.

6 Month Chart

5 Day Chart

1 Day Chart

Technical Analysis:

I LOVE THIS CHART. If it can beat $.43, I love it.

If it can’t, what comes up must come down!

There is not a lot of information on this company, just the one news release. There is something brewing and if it can beat $.43, it should be good for some %+++ gains!

Almost Bitcoin, Bitcoin Investment Trust (OTCMKTS:GBTC)

Bitcoin without Owning Bitcoin, Bitcoin Investment Trust (OTCMKTS:GBTC)

Bitcoin Investment Trust (OTCMKTS:GBTC) is a private, open-ended trust that is invested exclusively in bitcoin and derives its value solely from the price of bitcoin. It enables investors to gain exposure to the price movement of bitcoin without the challenge of buying, storing, and safekeeping bitcoins. The BIT’s sponsor is Grayscale Investments, a wholly-owned subsidiary of Digital Currency Group.

So for those of us that would like to invest/trade bitcoins but don’t want to have to deal with bitcoin wallets or transferring funds around you can easily use your current trading platform to purchase GBTC and trade just like any other stock.

https://www.otcmarkets.com/stock/GBTC/quote

Bitcoins Massive Run

Bitcoin has been on a massive run as of late with a value of more than $2,715 today per bitcoin and its not just the regular investors who are taking advantage of the opportunities presented with cryptocurrencies. Unless you have been hiding under a rock for the last few months you’ve heard someone or read something about Bitcoin and thats because its made a run from under $500 in 2015 to a current price of $2,715 6/20/17.

Im not going to try to explain what a bitcoin actually is because it seems that no longer matters, its the fact that the public, businesses, and even governments are beginning to recognize bitcoin is not going away.

What is a Bitcoin :

Bitcoin is a new currency that was created in 2009 by an unknown person using the alias Satoshi Nakamoto. Transactions are made with no middle men – meaning, no banks! There are no transaction fees and no need to give your real name. More merchants are beginning to accept them: You can buy webhosting services, pizza or even manicures.

No one knows what will become of bitcoin. It is mostly unregulated, but that could change. Governments are concerned about taxation and their lack of control over the currency.

Mcewen Mining Inc. (NYSE:MUX) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Mcewen Mining Inc. (NYSE:MUX) reported that Mcewen Robert Ross has picked up 78,787,355 of common stock as of 2017-04-27.

The acquisition brings the aggregate amount owned by Mcewen Robert Ross to a total of 78,787,355 representing less than 25.3% stake in the company.

For those not familiar with the company, McEwen Mining Inc. is a mining and minerals production and exploration company. The Company is focused on precious and base metals in Argentina, Mexico and the United States. The Company’s segments include Mexico, Minera Santa Cruz S.A. (MSC), Nevada and Los Azules. The Mexico Operations segment includes properties, such as El Gallo 1 mine and the El Gallo 2 project. The MSC segment includes properties, such as the San Jose mine and other concessions located around the mine. The Company’s properties in Nevada segment include Gold Bar project and exploration properties. The Gold Bar project is a proposed mine project. The Los Azules segment includes various properties, such as Los Azules project, Chonchones project, Laganoso project, La Cerrada project and Other Argentina properties. The Los Azules copper project is an advanced-stage porphyry copper exploration project located in the cordilleran region of San Juan Province, Argentina near the border with Chile.

A glance at Mcewen Mining Inc. (NYSE:MUX)’s key stats reveals a current market capitalization of 914.26 Million based on 299.57 Million shares outstanding and a price at last close of $2.94 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-06-28, Sutherland picked up 15,166 at a purchase price of $3.55. This brings their total holding to 470,000 as of the date of the filing.

On the sell side, the most recent transaction saw Ashby unload 10,000 shares at a sale price of $3.45. This brings their total holding to 42,500.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Mcewen Mining Inc. (NYSE:MUX) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

See Who Picked Rhino Resource Partners (OTCMKTS:RHNO) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Rhino Resource Partners, L.P. (OTCMKTS:RHNO) reported that Rhino Resource Partners Holdings Llc. has picked up 5,000,000 of common stock as of 2017-04-26.

The acquisition brings the aggregate amount owned by Rhino Resource Partners Holdings Llc. to a total of 5,000,000 representing less than 38.7% stake in the company.

For those not familiar with the company, Rhino Resource Partners LP is an energy limited partnership that is focused on coal and energy related assets and activities, including energy infrastructure investments. The Company produces, processes and sells coal of various steam and metallurgical grades from multiple coal producing basins in the United States. It operates through four segments. The Central Appalachia segment consists of over two mining complexes: Tug River and Rob Fork. The Northern Appalachia segment consists of the Hopedale mining complex, the Sands Hill mining complex and the Leesville field. The Rhino Western segment includes its underground mine in the Western Bituminous region. The Illinois Basin segment includes its underground mine, preparation plant and river loadout facility, and Taylorville field reserves located in central Illinois. Its other category consists of its ancillary businesses and remaining oil and natural gas activities.

A glance at Rhino Resource Partners, L.P. (OTCMKTS:RHNO)’s key stats reveals a current market capitalization of 53.74 Million based on 12.91 Million shares outstanding and a price at last close of $3.80 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-01-27, Weston picked up 100,000 at a purchase price of $10.00. This brings their total holding to 1,400,000 as of the date of the filing.

On the sell side, the most recent transaction saw Royal unload 83,334 shares at a sale price of $3.00. This brings their total holding to 6,593,578.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Rhino Resource Partners, L.P. (OTCMKTS:RHNO) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

A World Renowned ‘Big Mining’ Geologist Is Working To Build The Next Billion Dollar Junior Gold Company: Dataram Corp (NASDAQ:DRAM)’s US Gold Corp.

Back in 2011, as part of this interview conducted by Rockstone Research, mining analyst Stephan Bogner asked the interviewee, geologist David Mathewson, what drove him to become a part of the then young gold exploration company Gold Standard Ventures Corp (NYSEMKT:GSV). Bogner highlighted Mathewson’s career to that point – something we’ll look at in more detail shortly – as justification for the suggestion that a tiny explorer, worth just a few million dollars and with nothing in the way of confirmed resources at that point, wasn’t really worthy of the geologist’s time and attention.

When you’re one of the most respected geologists in the world, in other words, why devote your attention to a tiny player in the space?

Mathewson answered as follows:

“Successful exploration is all about applying effective and often new ideas, basically geological concepts, in entrepreneurial ways… public junior exploration companies provide the best vehicles to do exactly what needs to be done to be successful.”

This year, Gold Standard Ventures hit a market capitalization of more than $600 million. The development of the projects that account for the vast majority of this valuation, the Railroad-Pinion district and the North Bullion and Bald Mountain discoveries, was spearheaded by Mathewson during his time at the company.

Prior to his time at Gold Standard Ventures, Mathewson accrued more than thirty years’ worth of experience as a geologist in the gold sector, with the vast majority of this time spent in senior exploration positions at gold mining giant Newmont Mining Corp (NYSE:NEM). He served as Head of Exploration in Nevada for the company, and is credited with some of the major discoveries across the Carlin Trend and the Great Basin – two of the most resource rich gold areas in the world.

So, why are we talking about him here?

Well, a company called Dataram Corp (NASDAQ:DRAM) is on the verge of acquiring a company called US Gold Corp. Dataram is a NASDAQ traded technology company that is looking to diversify its operations, and it’s doing so through said acquisition, which management expects that (subject to shareholder approval) will close in between 60-90 days.

US Gold Corp. is a young, currently privately held (but soon to be available on the public markets by way of the just noted acquisition) natural resource miner, with two high-potential projects in Nevada and Wyoming.

The company’s CEO is Edward Karr, a respected investment banker. Its COO is David Rector, a gold industry veteran.

And here’s the most interesting part – VP, Head of Exploration is Mathewson.

What we’re looking at here, then, is a company that is in an almost identical position today, to that of the above-discussed Gold Standard Ventures back when Matheson joined at the turn of the decade. That is, it’s a young company with a couple of promising projects, looking to develop its assets into resources that it can sell to, or use as the basis of JV agreements with, incumbent mining entities.

If successful, and a look at Mathewson’s track record suggests there’s a good chance that under his direction it will be, we’re looking at a huge potential upside from current valuation (for reference, Dataram’s market capitalization as of April 24 is $5.8 million).

With this in mind, then, let’s look at the projects in question.

Two properties comprise the company’s asset portfolio right now. These are the Keystone project, located in Nevada, and the Copper King project, located in southeast Wyoming. The former, Keystone, is the project in which Mathewson has had a hand, and it’s likely going to be the primary value driver for the company going forward – that is, it’s the project on which US Gold Corp. is basing much of its long-term valuation.

As thing stand, however, it’s at an earlier stage of development than Copper King. To put this another way, Keystone is an exploration asset, while Copper King is a near-term production asset.

Copper King is located 20 miles west of Cheyenne, Wyoming’s capital, and most populous city. It’s what’s classed as an advanced exploration and development property, and it falls within the Silver Crown Mining District of the state, a district well known for its mining friendly economics.

Back in 2012, a group called Mine Development Associates (MDA) published a Preliminary Economic Assessment (PEA) detailing the resource and its estimates. As per the PEA, Copper King boasts the following:

- 1,534,000 Measured and Indicated gold equivalent ounces

- 345,000 Inferred gold equivalent ounces

- $159.5 million Net Present Value (NPV) at $1,100/oz. Au and $3.00/lb. Cu

Of course, gold is priced higher than the per oz. price used for this assessment (most recent spot price $1,256 versus the $1,100 used above), meaning the NPV is likely considerably higher than the PEA implies. Copper is down slightly ($2.55 versus the $3.00 used), but the negative impact on NPV that the decline in copper implies should be outweighed by the positive impact on NPV brought about by the rise in gold.

Over the coming twenty-four months, US Gold Corp. intends to execute on a development strategy that should bring with it numerous catalysts, each of which has the potential to induce an upside revaluation for the company as and when they hit press. During 2017, these catalysts include an updating of the PEA (to adjust the above-discussed cost inputs) and the initiation of a permitting strategy. During 2018, management expects to move to advance into a Pre-Feasibility Study (PFS), as well as continue to explore and develop the property to refine estimates (and potentially expand estimates) ahead of permitting.

Beyond this activity, we see a JV announcement, or the offloading of the property to a larger name (which is becoming an increasingly popular exit strategy in the junior gold space, based on the reduction in exploratory activity during the low-gold years) – each of which could initiate a dramatic upside revaluation.

That’s the Copper King project; what about Keystone?

As mentioned, this is the big one for the company. It’s the project Mathewson has identified as potentially being even more valuable than the Railroad resource that underpinned the Gold Standard Ventures $600 million valuation, and it’s the resource we’re looking to as providing numerous development-type catalysts in parallel to the Copper King advances.

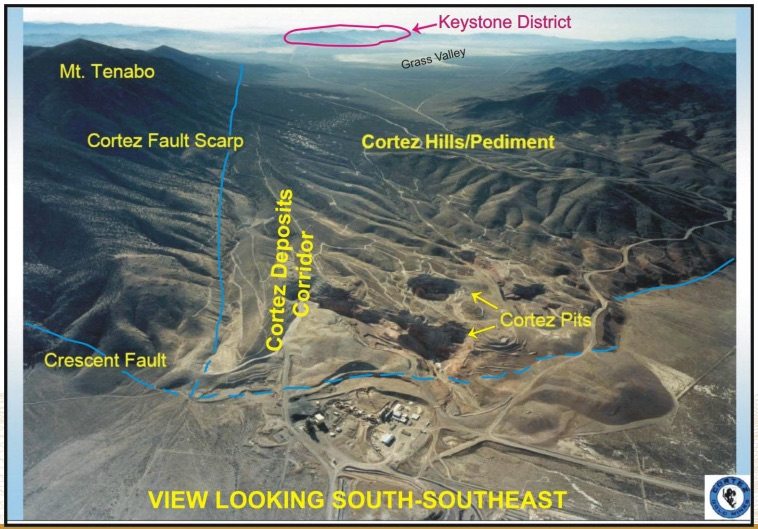

One of the most notable qualities of the project is that it’s located on the Cortez Gold Trend, just 10 miles south of Barrick Gold Corp (USA) (NYSE:ABX)’s Cortez mine – one of the largest mines in the world and one of Barrick’s flagship complexes, with nearly 10 million oz. in proven and probable reserves. The project produces around 1 million oz. annually. The image below illustrates the location of US Gold Corp.’s Keystone project in relation to the Cortez complex.

Mathewson recently discovered and consolidated the project, and US Gold Corp. is banking on the idea that this is his next big discovery, and that it will add to his long list of successful discoveries (and developments) in Nevada across his thirty-five-year career in the state.

The project itself covers more than 15 square miles of mining claims, and based on drilling to date, has been shown to contain high grade, thick intercepts of gold at very shallow depths. This means two things: that the extraction of the shallow resource should be relatively cheap, and that there’s likely more gold below the shallow intercepts.

So what’s next at the project – or in other words, where are the catalysts coming form with relation to Keystone?

The majority of 2017 will be spent surveying the property in an attempt to identify the potentially most rewarding regions, and claims, and to put together some solid estimates as to what the project might hold from a resource perspective. Once surveyed, Mathewson is going to identify initial drill targets (this is his specialty) and with these targets in place, the drilling program will kick off.

Throughout 2018, then, the company is going to execute on the drilling program and prove up its discoveries (and in turn, its estimates) on the back of the drill results.

Just as with Copper King, we expect (and this is supported by management communication) that the exit strategy on this one will be to develop to a point just pre-production, and then offload the project to a larger name, or strike a JV agreement. This helps the company to avoid the costs of a ramping up to production, while maintaining an interest in the gold that its team has worked to prove.

Bottom line: there are plenty of potential catalysts across the coming two years, a respected and experienced management team and one of the industry’s most well known, and highly regarded, geologists/explorers at the helm of the project’s advancement. US Gold Corp. is also debt free, and based on an October 2016 financing that saw the company net just shy of $12 million, is fully funded through end 2017.

This is early stage gold, so it’s not a risk-free exposure. That said, for an investor looking to allocate to the space who is also looking for a quality that puts said allocation ahead of its peers, US Gold Corp., and Mathewson, is the stock to watch.

Searchlight Minerals Corp. (OTCMKTS:SRCH) is Attracting Smart Money

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Searchlight Minerals Corp. (OTCMKTS:SRCH) reported that Luxor Capital Group has picked up 93,930,386 of common stock as of 2017-04-25.

The acquisition brings the aggregate amount owned by Luxor Capital Group to a total of 93,930,386 representing less than 26.1% stake in the company.

For those not familiar with the company, Searchlight Minerals Corp. is an exploration-stage company. The Company is engaged in a slag reprocessing project, the Clarkdale Slag Project. The Clarkdale Slag Project, located in Clarkdale, Arizona, is a reclamation project to recover precious and base metals from the reprocessing of slag produced from the smelting of copper ore mined at the United Verde Copper Mine in Jerome, Arizona. There is approximately 20 million tons of slag available to be processed at the Clarkdale site. The Company’s processing flow diagram consists of grinding the slag material using high pressure grinding rolls (HPGR), then pretreatment by melting the slag at high temperature, followed by leaching the slag in an autoclave. The Clarkdale Slag Project is located in Clarkdale, Arizona, approximately 107 miles north of Phoenix, Arizona and over 50 miles southwest of Flagstaff, Arizona in Yavapai County. The slag pile occupies approximately 45 acres on the property.

A glance at Searchlight Minerals Corp. (OTCMKTS:SRCH)’s key stats reveals a current market capitalization of 17.31 Million based on 345.60 Million shares outstanding and a price at last close of $0.05 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2016-03-18, Luxor picked up 31,712,229 at a purchase price of $0.04. This brings their total holding to 37,179,695 as of the date of the filing.

On the sell side, the most recent transaction saw Ager unload 5,900 shares at a sale price of 0.64. This brings their total holding to 0.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Searchlight Minerals Corp. (OTCMKTS:SRCH) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Delta Partners is Buying Good Times Restaurants (NASDAQ:GTIM) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Good Times Restaurants Inc. (NASDAQ:GTIM) reported that Delta Partners has picked up 901,586 of common stock as of 2017-04-24.

The acquisition brings the aggregate amount owned by Delta Partners to a total of 901,586 representing less than 7.3% stake in the company.

For those not familiar with the company, Icahn Enterprises L.P. (Icahn Enterprises) is a holding company. The Company’s segments include Automotive, Energy, Metals, Railcar, Gaming, Food Packaging, Mining, Real Estate and Home Fashion. The Company’s Investment segment includes various private investment funds. The Company operates its Automotive segment through its ownership in Federal-Mogul Holdings Corporation and IEH Auto Parts Holding LLC. The Company operates Energy segment through its controlling interest in CVR Energy, Inc. It operates its Metals segment through its subsidiary, PSC Metals, Inc. The Company operates its Railcar segment through its ownership interests in American Railcar Industries, Inc. Its Food Packaging segment consists of ownership in Viskase Companies, Inc. The Company’s Real Estate operations consist of rental real estate, property development and associated resorts. It also owns a limited partner interest in Icahn Enterprises Holdings L.P. (Icahn Enterprises Holdings).

A glance at Good Times Restaurants Inc. (NASDAQ:GTIM)’s key stats reveals a current market capitalization of 37.56 Million based on 12.30 Million shares outstanding and a price at last close of $3.20 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-03-13 Hoback picked up 2,315 at a purchase price of $2.90. This brings their total holding to 35,053 as of the date of the filing.

On the sell side, the most recent transaction saw Heller unload 10,000 shares at a sale price of $3.48. This brings their total holding to 2,667.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Good Times Restaurants Inc. (NASDAQ:GTIM) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.

Point State Capital is Buying Peabody Energy Corp (NYSE:BTU) Shares

In a just published Form 13, filed with the US Securities and Exchange Commission (SEC), Peabody Energy Corp (NYSE:BTU) reported that Point State Capital has picked up 4,621,113 of common stock as of 2017-04-13.

The acquisition brings the aggregate amount owned by Point State Capital to a total of 4,621,113 representing a 5.0% stake in the company.

For those not familiar with the company, Peabody is the world’s largest private-sector coal company and a Fortune 500 company. The company is also a leading voice in advocating for sustainable mining, energy access and clean coal technologies. Peabody serves metallurgical and thermal coal customers in more than 25 countries on five continents.

A glance at Peabody Energy Corp (NYSE:BTU)’s key stats reveals a current market capitalization of 2.44 Billion based on 18.49 Million shares outstanding and a price at last close of $23.82 per share.

Looking at insider activity, there are a few transactions worth noting.

Specifically, on 2017-04-06, Elliott picked up 124,440 at a purchase price of $27.50. This brings their total holding to 8,555,551 as of the date of the filing.

On the sell side, the most recent transaction saw Discovery unload 220 shares at a sale price of $27.25. This brings their total holding to 13,045,282.

It’s possible to gauge a company’s potential by tracking the activity of its major holders, as well as checking in on insider activity such as those transactions listed above. We’ll be keeping an eye on Peabody Energy Corp (NYSE:BTU) as things move forward to see if its progress aligns with these transactions.

Subscribe below and we’ll keep you on top of what’s happening before it moves markets.